Our Business Units

The strategic goals of the Strategy Vision 2030 were applied to the airport group’s business areas. These business units are also subject to overarching guidelines: cost efficiency, digitalization, manufacturing scope and depth, risk diversification, and sustainability.

Aviation business unit

Munich Airport ensures connectivity for the people and businesses based here. It can be assumed that demand for air travel will continue to develop positively due to the economic strength and attractiveness of Bavaria and the southern German region as an incoming destination, despite current uncertainties. Munich Airport is crucial as a gateway for this region.

With 31.7 million passengers in 2022, the location has grown at an above-average rate compared to the rest of Germany. With China expected to gradually open up as the last major market, passenger numbers are expected to return to pre-crisis levels in 2024 or 2025 at latest. The goal is to achieve lasting stability in its position as one of the leading hubs in the European aviation market, which is experiencing further consolidation. Long-haul and transfer traffic will therefore be the essential cornerstones of the aviation strategy in the medium to long term, too.

The Lufthansa Group’s decision to base its reactivated Airbus A380 aircraft exclusively at Munich Airport from summer 2023 is a strong expression of its commitment to the Bavarian hub within Lufthansa’s multi-hub system. Further destinations in point-to-point traffic are to increase the variety and attractiveness of the service. One crucial aspect here will be keeping infrastructure and process quality at a high level and thereby strengthening the company’s position as it competes with other airports.

Airfreight has also benefited from the traffic boom at Munich Airport. Freight volumes in 2022 increased by 55 percent year-on-year to a total of around 259,000 tonnes. Furthermore, the development of our cargo and logistics business aims to account for the central importance of global, functional supply chains.

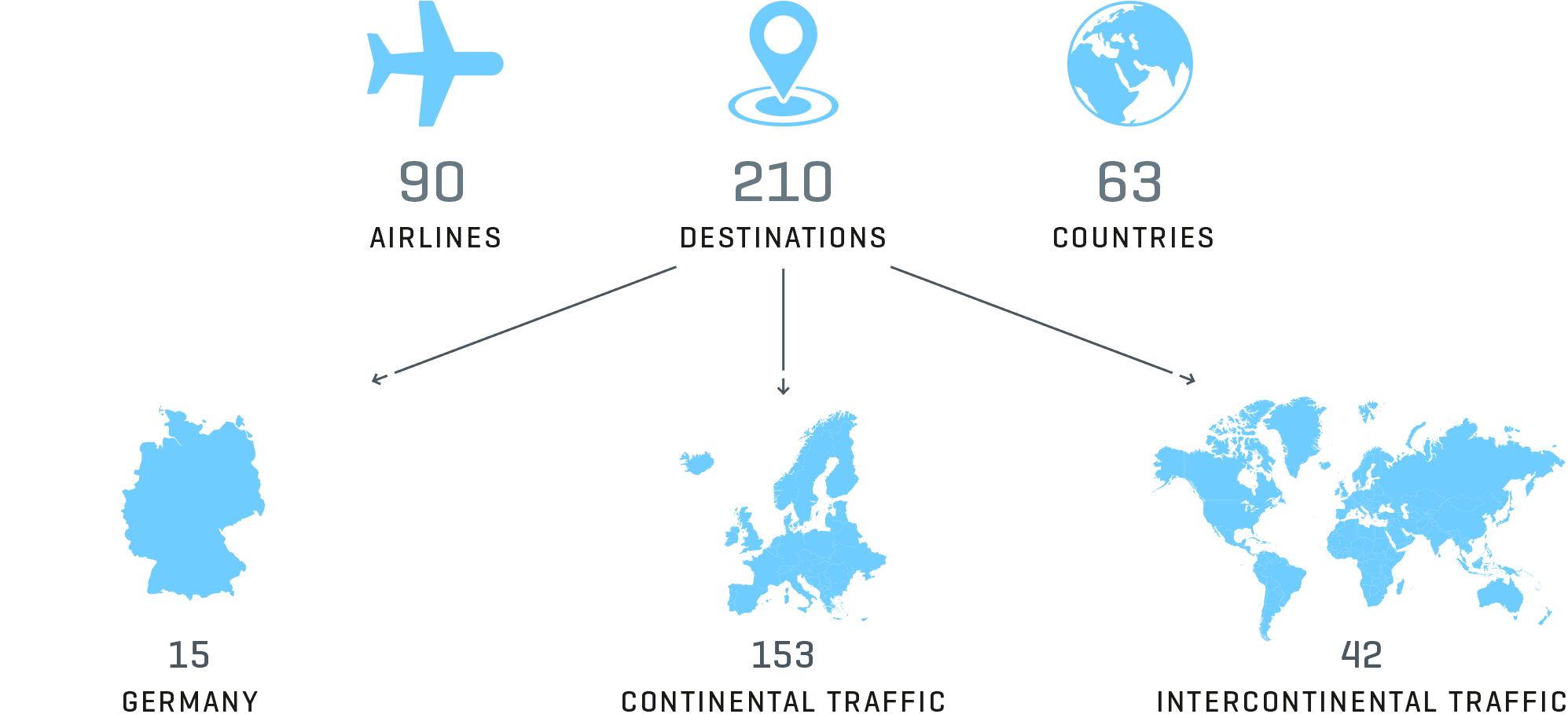

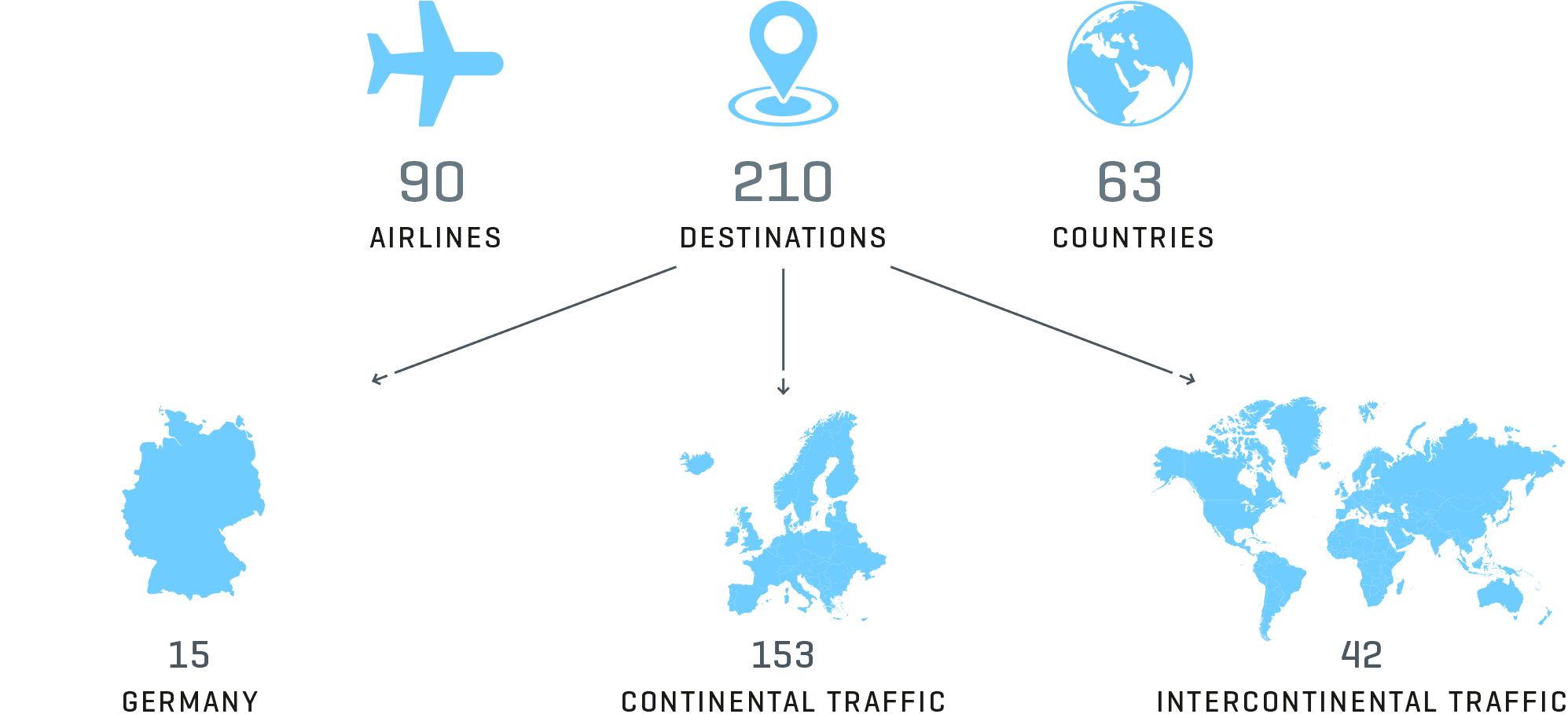

Transport network & destinations

FMG and Lufthansa: a bilateral commitment to a long-term partnership

In January 2023, Flughafen München GmbH and Deutsche Lufthansa AG signed a letter of intent committing to a joint sustainability strategy, the development of Munich Airport into an intermodal traffic hub, the expansion of infrastructure according to demand, and the promotion of digitalization and innovations in operations.

The partnership with Lufthansa began back in the late nineties. With the joint construction and operation of Terminal 2, which opened in 2003, we have launched a model of cooperation that is unique in Europe and established Munich Airport as a premium hub with high-quality connections to attractive destinations worldwide. The satellite building commissioned in April 2016 marked the first expansion stage for this successful joint venture. Starting in the summer of 2023, Lufthansa will reactivate its Airbus A380 and base four of the world’s largest passenger aircraft in Munich. As early as June, three of these long-haul aircraft, which can accommodate more than 500 passengers, will be ready to fly to destinations in the USA.

In order to remain competitive in the long term, both companies are driving forward the achievement of their sustainability goals so that the entire Munich location will benefit from this. The Lufthansa Group plans to cut its net CO₂ emissions in half by 2030 compared with 2019 and also aims to achieve a neutral CO₂ balance by 2050. The Group is focusing on accelerated fleet modernization, continuous optimization of flight operations, the use of sustainable aviation fuels, and innovative offers to make air travel or the transport of cargo CO₂-neutral.

Commercial Activities business unit

Passenger numbers recovered as the pandemic subsided, reviving our commercial business in 2022: Demand increased in all areas of this business unit. In the Retail and Catering segments, we have conducted talks with all tenants to secure contractual relationships and develop prospects in the interests of sustainable business relationships and the economic situation on both sides. New tenants were found for some of the vacancies that resulted from the effects of the pandemic – for example, due to business closures or the termination of contractual relationships.

In advertising, a particular focus in 2022 was on acquiring new customers in the automotive and tourism sectors. The solidification of existing brand partnerships was successfully driven forward, particularly in these industries.

In the Parking division, a change in customer structure coincided with the recovery in air traffic. An increase in the share of individual travel, in particular by leisure travelers, contrasted with a significant drop in business travel volumes. We have therefore placed emphasis on online marketing, which is particularly relevant for vacation travelers. Various parking infrastructure redevelopment projects are currently tightening parking capacity, resulting in high utilization as early as 2022.

The goal of the Commercial Activities business unit is to secure and expand FMG’s value proposition in the face of changing consumer behavior. Central to this is the optimization of space efficiency and the portfolio of offerings as well as increasing customers’ willingness to make purchases. Changing retail structures and consumer habits also call for new marketing and acquisition concepts. Offering customers a special experience at Munich Airport is also one of the tasks in this business unit. Staging in the terminal areas, the presentation of strong brands, and extraordinary events in the Forum of the Munich Airport Center (MAC) all play a part in this.

Real Estate business unit

The Real Estate business unit ensures that buildings and space are made available as needed for Munich Airport’s value-added processes. In addition, the real estate business is being positioned in the third-party market. The ongoing development of the entire real estate and space portfolio and the networking required for this is of great importance for the location.

Using real estate as a means of securing the core business of aviation

Sustainability is the essential guideline for the development and operation of real estate at the airport. The portfolio of real estate and infrastructure, some of which dates back to the time when the airport first went into operation, will be successively modernized over the coming years. The expectations of air travelers and visitors for a high quality of visit are also key factors. The new pier at Terminal 1 is one example of a pioneering investment in the future, which takes account of the requirements of a modern terminal infrastructure.

To continue to ensure smooth air traffic at the Munich hub, Terminal 1, the central building, and the existing parking garages will be extensively refurbished and modernized over the next few years. In addition to optimizing passenger processes, special attention is being paid to the customer experience at the airport. The central zone with the two terminals, the central building, and the MAC form the commercial nucleus of Munich Airport.

Generating substantial contributions to profits by developing real estate

FMG plans to tap into new revenue sources of revenue outside the traditional portfolio through a series of major projects. For example, in addition to the completion of the office buildings on the LabCampus, space for testing autonomous driving was transferred to the business partners. The agenda also includes the sale of a plot of land owned by the airport for the construction of a multifunctional arena by a third-party investor with considerable synergy potential.

Taking account of regional interests

The real estate strategy is carefully calibrated to accommodate the interests and concerns of the airport area in terms of both the development of Munich Airport as a whole and the many construction projects that are planned. FMG maintains an intensive dialog with the region. The marketing of airport real estate focuses on target groups and companies that value proximity to the airport and an international environment when choosing a potential location.

Expansion of international business

Over the past 30 years, Munich Airport has evolved from a consultant for airport relocation and operations to a management services provider of international airport infrastructure. In this way, we are promoting value-driven growth beyond the Munich site, tapping into new business models and continuously expanding our own expertise as an airport operator. The further development of the consulting and management segment is scheduled for 2023.

Munich Airport markets its expertise worldwide through the Group subsidiary Munich Airport International GmbH (MAI). MAI is a valued partner for strategic investors and emerging aviation companies around the world, not least because of the recognized quality at its home base. Together with its subsidiaries, MAI also successfully completed existing projects and acquired new customers in 2022 despite ongoing crises. For example, the opening of the new Terminal A at Newark Liberty International Airport (EWR) took place after more than three years of intensive preparation. A new project was also acquired in Thailand. With the opening of the regional office in Singapore, MAI is reinforcing its commitment to the Asian aviation market. Our local presence enables us to maintain even closer contact with our customers and business partners in this region.

Projects 2022

America

From November 2021 to February 2022, MAI assisted the Houston Airport System (HAS) in evaluating the ORAT program currently underway.

Between May and December 2022, MAI, together with its subsidiary amd.sigma, provided master plan consulting services to three regional airports in the Cayman Is-lands.

In September 2019, the subsidiary Munich Airport NJ LLC took over operation of the former Terminal A. MAI is supporting the Port Authority of New York and New Jer-sey in the technical and operational planning of the new Terminal A at Newark Lib-erty International Airport (EWR), coordinating the commissioning of the new termi-nal and the relocation to it, and will take over operation of this terminal for a 15-year period in early 2023.

From November 2017 through May 2022, MAI assisted a consortium in ac-quiring a concession for the design, development, construction, and operation of the new Terminal 1 at New York’s John F. Kennedy International Airport (JFK). A new central terminal with 23 new gates is to be built by around 2030 to replace the current Terminals 1, 2 and 3. MAI provided consulting services during this phase of the project and is preparing for the operational readiness and airport transition (ORAT) of the new terminal.

Middle East

MAI completed its first cargo project in the region in the spring of 2022. From 2020 to spring 2022, MAI successfully implemented the ORAT for SAL Saudi Logistics Ser-vices, ensuring the activation of two new cargo facilities with a total capacity of over 1.4 million cargo tons per year at King Khalid International Airport in Riyadh and King Abdulaziz International Airport in Jeddah.

From April to December 2022, MAI worked for the operator of Hamad International Airport in Doha. MAI successfully implemented the ORAT of the north node exten-sion. In addition, a team from MAI worked with aerogate from October to Decem-ber 2022 in Doha to prepare the airport for the greatly increased passenger traffic during the World Cup.

Europe

In 2020, the SOF Connect consortium consisting of Munich Airport and the companies Meridiam and Strabag SE signed the concession contract for Sofia Airport with the Bulgarian Ministry of Transport. In 2021, SOF Connect assumed long-term operation of Sofia Airport with its partners and is working specifically on the optimization, expansion and traffic development of the Bulgarian capital’s air-port. MAI provides management, consulting and training services.

Asia

In November 2020, MAI was awarded a contract to support the commissioning and commercial development of an airport in Uzbekistan. The project was successfully completed in mid-2022 with the successful commissioning of the new terminal, several weeks of post-opening support and additional support in the area of airline marketing.

After more than 16 years, MAI has once again succeeded in securing a consultancy contract in Thailand. MAI’s experts have been commissioned to assist in the devel-opment and design of the new U-Tapao International Airport, which will be located approximately 60 kilometers southwest of Bangkok.

Munich Airport International is reinforcing its commitment to the Asian aviation market by opening a regional office in Singapore. The Asia-Pacific region is a key market for MAI.

Scouth America

Since September 2022, MAI has been working with a Latin American infrastructure investor in the field of AAM (Advanced Air Mobility), assisting in the definition of the regional market strategy, which includes the analysis of the potential AAM mar-ket, the proposal of a market entry strategy, and the outline of a vertiport network and the corresponding traffic forecast. AAM refers to the use of small, semi-automated aircraft to transport passengers. The product was developed in re-sponse to traffic congestion and the need for more sustainable mobility concepts.

In addition, in 2022 MAI experts were active in the Netherlands, Nigeria, Taiwan, Luxembourg, and the Philippines.