Economic environment

Macroeconomic environment

The economy recovers from the slump caused by the crisis

Both national and international economic growth are crucial for a global air traffic hub such as Munich Airport.

In 2022, the global economy was negatively affected by the impact of the war in Ukraine and China’s strict zero covid policy. Supply shortages and high energy prices increased production costs and inflation. Industry and private consumption suffered as a result, and economic uncertainty increased. Global real gross domestic product (GDP) grew by 2.8% in 2022 (2021: 6.2%), which was 1.6% below the previous year’s forecast. 4)

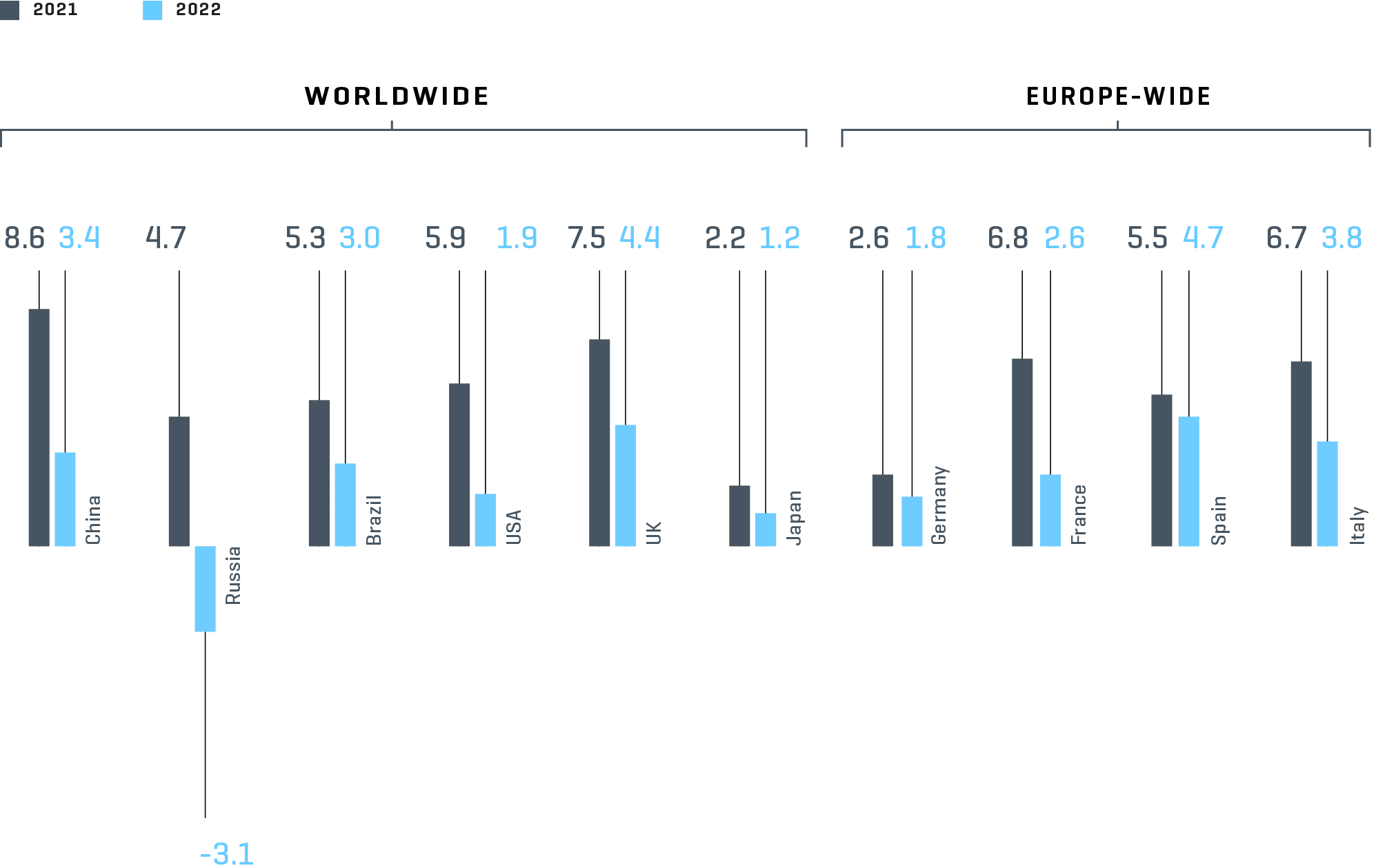

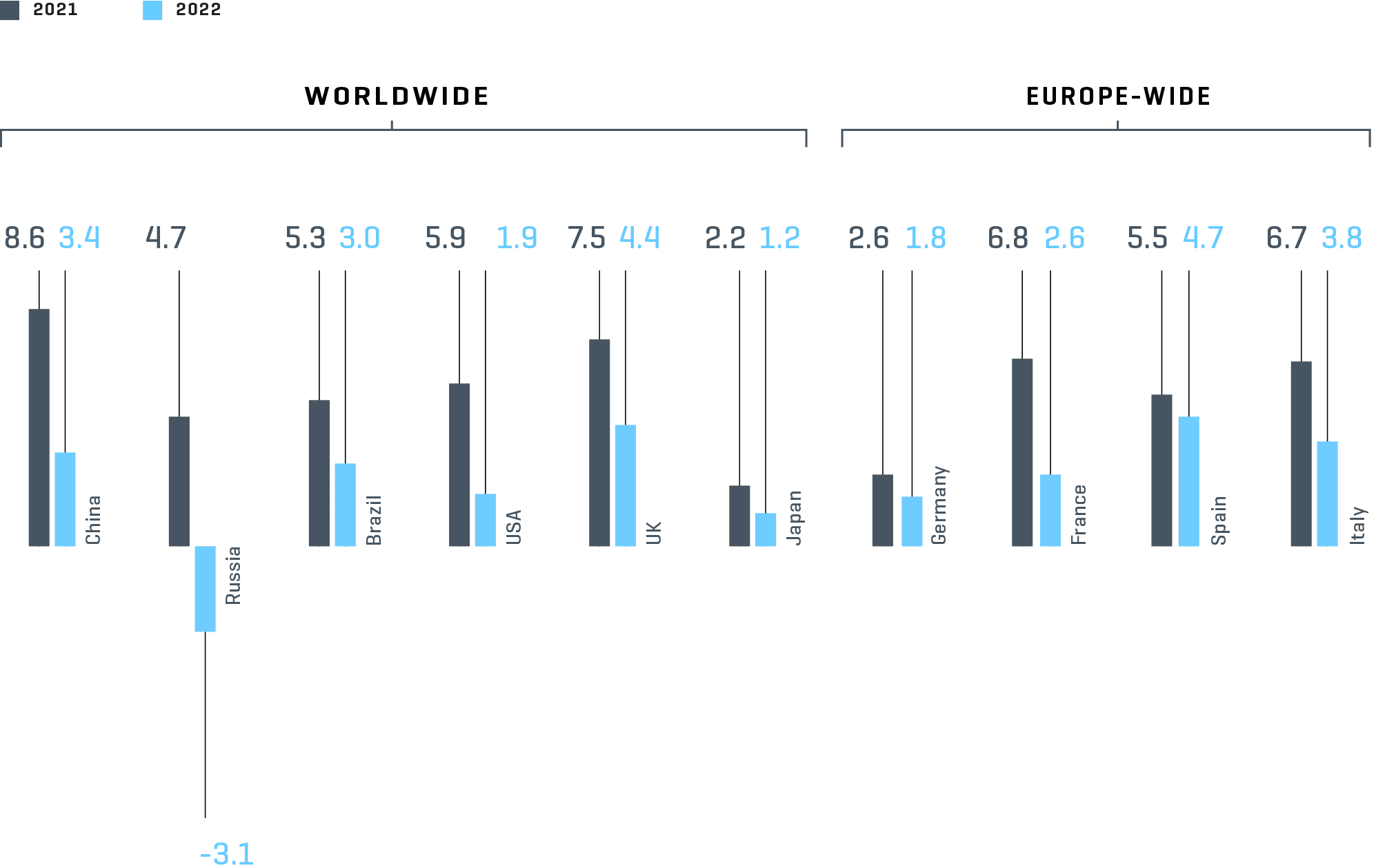

In the emerging markets, the economy grew at an overall rate of 3.4% (previous year: 8.0%). The Chinese economy suffered as a result of the strict coronavirus mitigation measures and the continued real estate crisis, leading to relatively weak growth of 3.4% for 2022 (2021: 8.6%). In India, another coronavirus wave at the beginning of 2022 put a damper on private consumption and resulted in a weaker GDP in the first half of the year. Overall, however, the growth rate for 2022 was relatively solid (6.1%). 4)

Economic growth of selected countries (worldwide and Europe-wide)

GDP growth 2021 and 2022 1) (in %)

- ifo Institute, Economic Forecast Winter 2022, December 2022

In 2022, economic growth in industrial nations was hampered by high inflation rates, significantly higher energy prices, great economic uncertainty and persistent supply chain interruptions. In particular, the big increase in energy prices created a number of challenges for the advanced economies. Accordingly, economic growth slowed down considerably compared to 2021. Overall, the leading economies recorded a 2.5% increase in the GDP for 2022 (2021: 5.3%). The U.S. economy grew by 1.9%. High inflation and higher interest rates put pressure on consumer demand and investments. The British economy grew by 4.4% thanks to a booming service and construction sector. The same cannot be said for industrial production and retail, however. 4)

The economy in the euro zone grew by 3.4%. Initially, the lifting of most pandemic measures in the spring of 2022 was good news for the service sector. However, as inflation rates started to rise, private consumption started to suffer as the year progressed. Supply bottlenecks for energy, raw materials and primary products had a negative effect on industrial production. The monetary policy pursued by the European Central Bank (ECB) became much more restrictive as inflation increased. Investment activities were also curtailed by higher interest rates. The European labor market continued to be robust. Based on a long-term comparison, the unemployment rates in the member states were low. 4)

In 2022, Germany’s economic growth was affected by various supply shocks, as shortages in energy, primary products and labor hampered production. This had the effect of driving up inflation to 7.8% (average over the year). Private consumption increased by 4.6% after most coronavirus measures were lifted, and also because of the savings that were accumulated during the pandemic. Imports and exports grew by 5.8% and 2.8%, respectively. However, gross fixed asset investments saw little growth due to a weak construction sector (+0.1%). The unemployment rate fell by 0.4 percentage points year-on-year to 5.3%. Overall, the German GDP increased by 1.8% in 2022. 5)

In 2022, the oil price (Brent) fluctuated in a range between $74 and $133 per barrel. The price was highest at the beginning of March and lowest at the beginning of December. At the end of the year, the oil price was around $84 per barrel. 6)

Economic environment air traffic (Aviation)

Air traffic recovers as most coronavirus measures are lifted

At the beginning of the 2022 summer flight schedule, air traffic recovered noticeably after most coronavirus measures were lifted. At the same time, labor shortages at European airports meant that services were at times severely curtailed. At the level of individual airlines, aircraft that were put into storage during the pandemic were not available quickly enough. 7)

According to the data of IATA (International Air Transport Association), which is based on revenue passenger kilometers (RPK), passenger traffic in 2022 reached 68.5% of the level before the crisis (2019). Compared to the previous year, this represents an increase of 64.4%. The global capacity utilization of aircraft was 78.7%. Developments in Europe were very favorable, with +100.2% RPK and 81.2% capacity utilization. 8)

Globally speaking, the increase in air cargo in 2021 did not continue into 2022 (according to IATA analyses). Reasons included expensive fuel, high inflation, a weaker economy and the war in Ukraine. Globally flown «cargo tonne kilometers» declined by 8% and remained at a high level (–1.6%), however just below the reference period in 2019. 9)

European aviation security provider Eurocontrol analyzed air traffic developments in individual European states for June to September (compared to the 2019 base year). The analysis revealed that flights were only down 13.1% in 2022, whereby developments in Germany lagged behind other European countries. 10)

The airports organized in the German Airports Association (ADV) recorded significantly better traffic figures in 2022 than in the previous year. A total of 165.3 million passengers (+110%) were handled – a value that was still 34.1% lower than the 2019 result. At 5,051,672 tonnes (or –6.6%), cargo volumes (air freight and air mail handling) did not reach the high of the previous year but was still 5.2% higher than in 2019. 11)

The German Aviation Association (BDL) confirmed the recovery of the German air transport market following the lifting of travel restrictions. For example, the number of seats available in Germany increased by 80% compared to the previous year. The weakest segment was the domestic travel segment, which only reached 29% of the 2019 level. Intercontinental and continental traffic performed much better with 62% and 69% of the 2019 volume. 12)

Media reports on the air traffic report of ACI Europe also reveal a significant recovery of 98% for 2022 (compared to the previous year). However, passenger volumes are still 500 million passengers short of the pre-crisis levels of 2019. Among the larger European markets, Germany was the worst performer (–34.9% compared to 2019), behind Spain (–11.4%), Italy (–17.9%), France (–18.8%) and the UK (–24.8%). Strong growth in some markets is due to the high travel volumes in the private/vacation segment and the strong recovery in the low-cost sector. Because of this effect, air traffic volumes increased by +55.7% in Albania, +26.1% in Kosovo and +20.4% in Bosnia-Herzegovina, compared to the pre-crisis year 2019. 13)

Economic environment Commercial Activities

Retail sector grows mainly in the stationary segment

Despite the coronavirus pandemic and a trend toward increased savings and less consumption, according to the Association of German Retailers (HDE), compared to the previous year sales revenues generated by German retailers grew by 7.2% to EUR 631.9 billion, which corresponds to a real growth rate of –0.8%. Most of the nominal growth was generated in the stationary retail segment (compared to 2021: +8.8%). 14)

In the retail sector, the business climate index fell significantly; by 20 points year-on-year in December 2022. 15)

Food service and hotel industry – sales very positive

Compared to the previous year, sales in the food and hotel sector improved significantly (+55.7% nominally, and 45.4% on a price-adjusted basis). 16)

The individual business sectors showed the following changes compared with the previous year: Sales at hotels and other lodging establishments grew by 76.7%, which corresponds to a gain of 63.8% on a price-adjusted basis. The food service sector recorded a real increase in sales of 48.3% (real 38.7%), and the catering sector recorded an increase of 41.8% (real 32.4%). 16)

Advertising industry – Outdoor advertising reaches new record

In the out-of-home advertising category relevant to the airport, a sales record of €2.6 billion was achieved. Gross sales grew by 2.1% compared to the previous year. This performance even surpassed the previous record-breaking year of 2019. 17)

Parking – Dependence on passenger volumes and passenger mix

Higher passenger volumes have increased demand for parking. However, the high-revenue business passenger segment is much smaller compared to 2019. Having said that, most of the shortfall was successfully compensated with higher volumes of individual travelers.

Economic environment Real Estate

Munich office leasing market with best result in four years

In 2022, Munich’s office leasing market was able to overcome the crisis caused by the pandemic, generating a take-up of 754,400 m² (2021: 567,800 m²). Lease revenues without owner-occupiers were 10% above the previous year’s value (671,700 m²). New building projects continued to do well with 51% of take-up. 18)

At the end of 2022, 175,000 m² more space was available for immediate lease than in the previous year. With total available space of 1.23 million m² (Dec. 31, 2021: 1.05 million m²), this represents a vacancy rate of 5.4% in 2022, compared to 4.7% in 2021. 18)

Based on the concentration of tenants in new build premises and central locations, leases continued their upward trend. The average lease rose by 3% to 24.20 EUR/m² (2021: 23.50 EUR/m²), with top leases increasing by 5% to 43.50 EUR/m² (2021: 41.50 EUR/m²). New builds in the city generated 30.50 EUR/m² on average. Overall, offered lease rates are at the previous year’s level. The most recently published value for the average lease in the surrounding area was 13.70 EUR/m². Increased incentives (particularly outside of central locations) also highlight the fact that vacancy rates have risen. 18)

As of the closing date, approximately 1.1 million m² of office premises were under construction, with 61% already leased or occupied by the owner. Companies increasingly prefer new builds over available existing space. As there are still numerous projects in the pipeline, it is impossible to say whether new build projects will be fully leased by the time they are completed. A marketing period of several quarters after completion is normal. 18)

Because of the difficult economic situation, which takes three to four quarters to be reflected in the office leasing market, it is expected that demand will decline again in 2023. Take-up is expected to be in the range of 650,000 m². This would represent a decrease of about 14%. In 2022, the volume of speculative construction was less than in the three years prior. In terms of leases, the upward trend may continue as tenants continue to focus on high-quality premises and central locations. 18)

- ifo Institute, Economic Forecast Winter 2022, December 2022; German Council of Economic Experts, Annual Report 2022/23 November 2022

- ifo Institute, Economic Forecast Winter 2022, December 2022

- www.onvista.de

- Handling problems Münchner Merkur 13.11.2022 / Chaos at airports, but not in Munich, Abendzeitung 13.06.22

- IATA-Air Passenger Market Analysis December 2022

- IATA-Air Cargo Market Analysis December 2022

- Eurocontrol-road-to-recovery-data-snapshot-36 / Eurocontrol-Path-to-recovery-data-snapshot-38

- ADV, ADV Monthly Statistics 12/2022

- BDL_Presentation Annual Figures 2022.pdf

- International-Airport-Review-ACI-Europe-2022.pdf

- HDE, Annual Press Conference January 2023

- ifo Business Climate Germany by Economic Sector

- Press Release No. 066 17 February 2023– Federal Statistics Office

- Nielsen Marketing trend December 2022, February 2023

- Colliers: Munich’s office leasing market with best result in four years – Press release 10 January 2023