Results of operations, assets and financial position

Results of operations

Earnings after taxes – visible upswing

In fiscal year 2022, Munich Airport’s earnings after taxes (EAT) improved by TEUR 202,501 to –TEUR 58,794. The developments are explained in detail below.

Results of operations

TEUR

| Change | ||||

|---|---|---|---|---|

| 2022 | 2021 | Absolute | Relative in % | |

| Revenue | 1,187,988 | 601,276 | 586,712 | 97.6 |

| Other income | 45,337 | 79,206 | –33,869 | –42.8 |

| Total revenue | 1,233,325 | 680,482 | 552,843 | 81.2 |

| Cost of materials | –421,965 | –249,702 | –172,263 | 69 |

| Personnel expenses | –500,035 | –419,095 | –80,940 | 19.3 |

| Other expenses | –72,672 | –57,501 | –15,171 | 26.4 |

| EBITDA | 238,653 | –45,816 | 284,469 | >100.0 |

| Depreciation and amortization | –266,400 | –239,851 | –26,549 | 11.1 |

| EBIT | –27,747 | –285,667 | 257,920 | –90.3 |

| Financial result 1) | –37,611 | –50,590 | 12,979 | –25.7 |

| EBT | –65,358 | –336,257 | 270,899 | –80.6 |

| Income taxes | 6,564 | 74,961 | –68,397 | –91.2 |

| EAT | –58,794 | –261,296 | 202,502 | –77.5 |

- this also includes the results from companies accounted for using the equity method.

The noticeable traffic recovery in 2022 led to an increase in revenue from airport charges from TEUR 187,437 to TEUR 445,565 (+137.7%). Nevertheless, sales revenues are still below the pre-crisis year 2019 and are dominated by the impact of the coronavirus pandemic and the war in Ukraine.

Revenues from handling services also increased by TEUR 68,229 to TEUR 142,174 as a result of higher aircraft movements and passenger volumes.

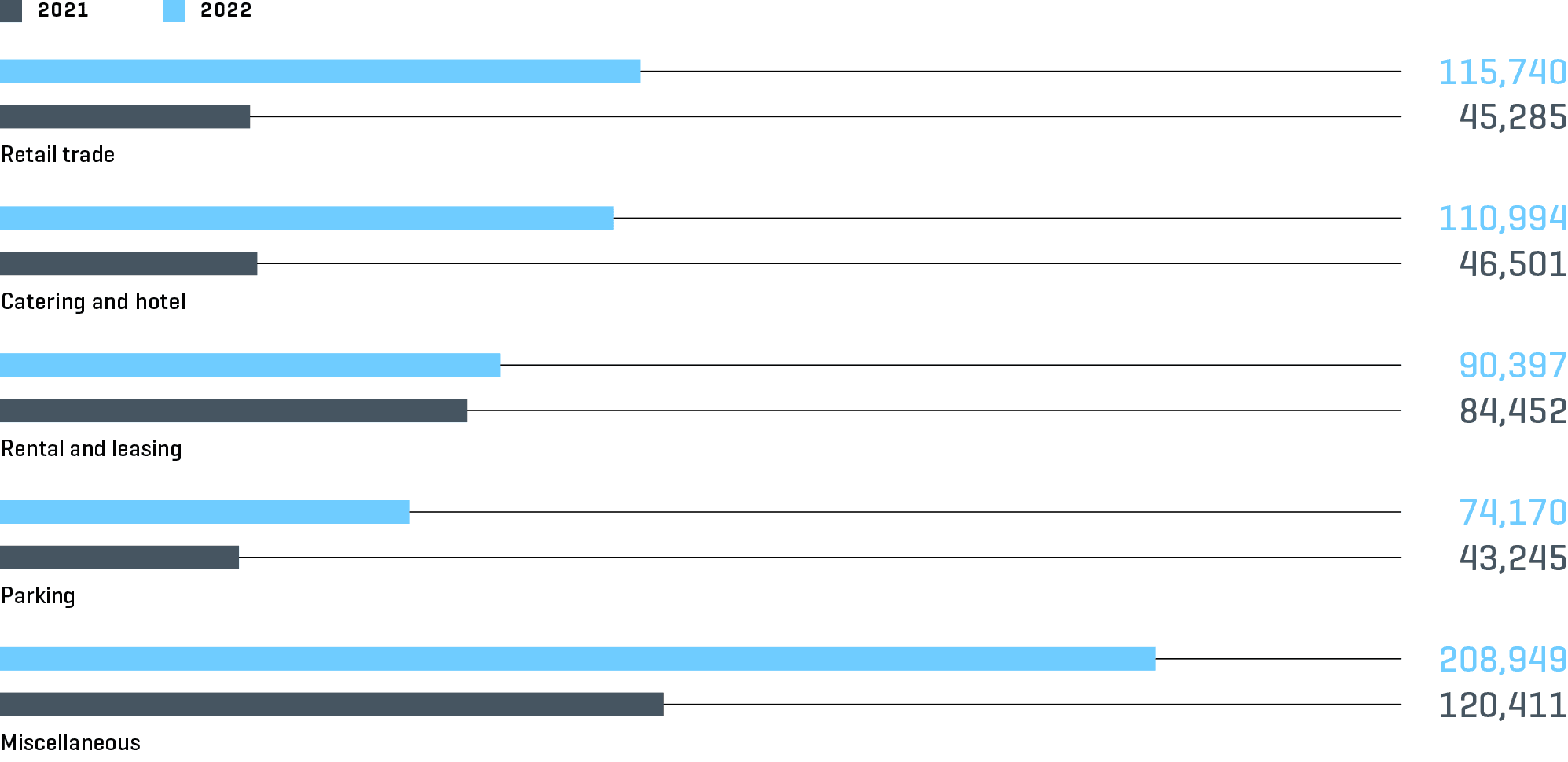

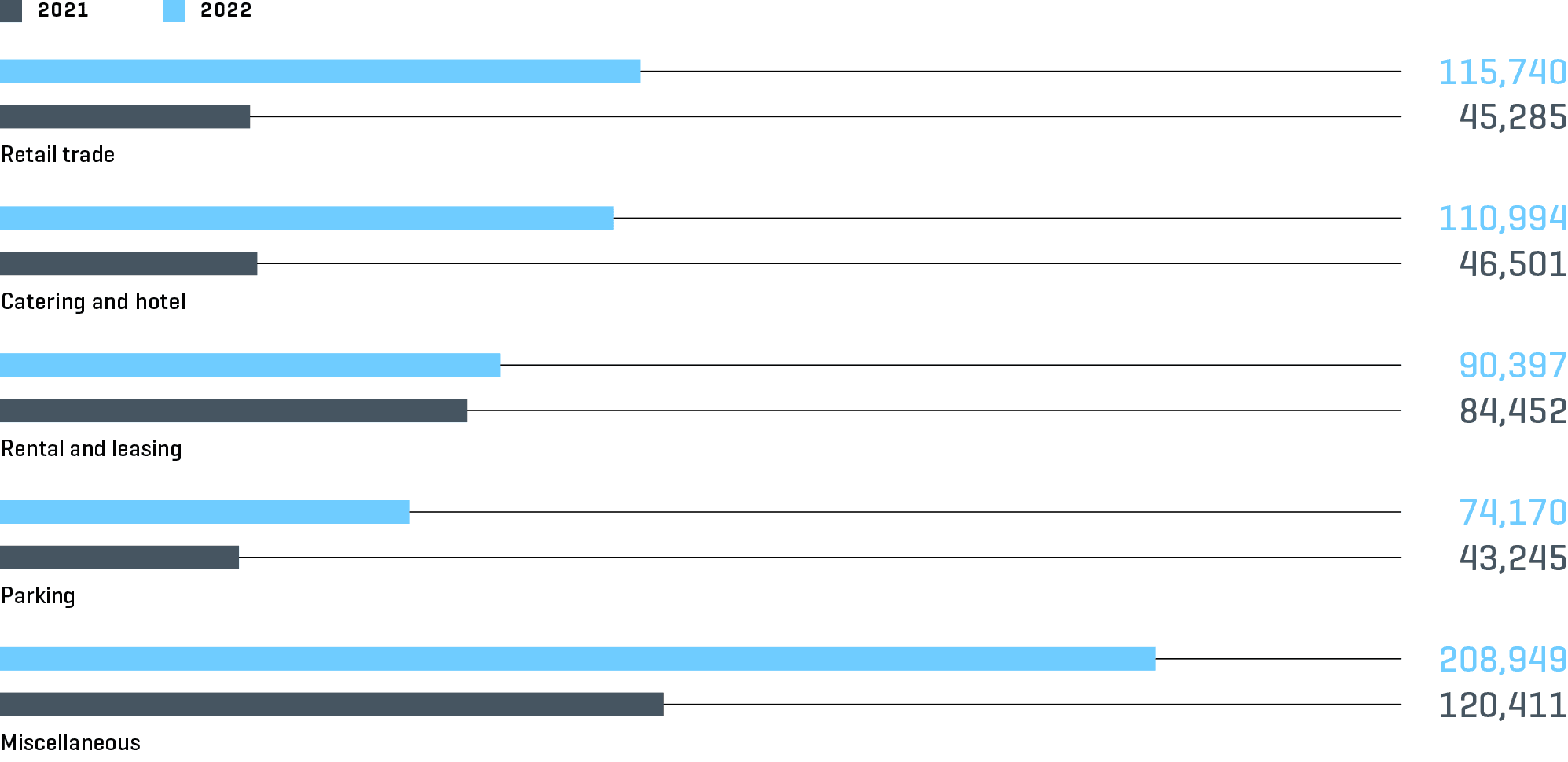

Revenue in the other divisions developed as follows:

Breakdown of revenues of other areas

in TEUR

Other revenues include global management, consulting and training services for the aviation industry amounting to TEUR 67,196 (2021: TEUR 26,747).

After almost 30 years of operation, the need for renovation of the buildings from the first expansion phase of Munich Airport continues to grow. Accordingly, expenses for refurbishment, optimization, and conversion measures increased by TEUR 19,572 to TEUR 117,161, primarily in the course of the modernization carried out at the hotel in 2022. In the context of the war in Ukraine and the resulting global impacts, expenditures for energy and utility services grew at a disproportionate rate (+TEUR 25,976). The remaining items in the cost of materials increased mainly as a result of the significant increase in air traffic. Overall, the cost of materials increased by TEUR 172,263 (+69.0%).

Munich Airport’s personnel expenses increased mainly due individual short-term relief programs for employees, e.g. rate hikes or driving cost allowance increases that went into effect at an earlier date. In addition, short-time work was only used at the beginning of 2022. Overall, the average number of employees decreased from 8,569 to 8,329.

Other expenses (TEUR 72,672) were higher than in the previous year – mainly as a result of higher consulting and project costs as well as expenses for advertising and public relations. In contrast, items such as other taxes declined.

Depreciation and amortization (TEUR 266,400; 2021: TEUR 239,851) includes impairment losses on assets of TEUR 59,715 (2021: TEUR 31,081). In the 2022 fiscal year, these relate mainly to assets (TEUR 42,889) that were remeasured due to the loss of tenants and higher interest rates. In the previous year, the impairments related mainly to assets that were measured based on newly concluded rental agreements (TEUR 26,300).

The financial result (including the result from companies accounted for using the equity method) improved by TEUR 12,979 to –TEUR 37,611. This development was mainly due to the increased interest rates as well as the resulting (and significant) discounting of long-term provisions.

Income taxes include actual tax expenses of TEUR 1,309 (2021: TEUR 2,587) and deferred tax income of TEUR 7,873 (2021: TEUR 77,548). The deferred tax income is mainly due to the recognition of tax losses carried forward, since the Group companies expect to generate positive results again in the coming years.

Assets and financial position

Assets – Munich Airport continues to secure its liquidity

Financial position

in TEUR

| Change | ||||

|---|---|---|---|---|

| Dec. 31, 2022 | Dec. 31, 2021 | Absolute | Relative in % | |

| Non-current assets | 5,264,038 | 5,328,662 | –64,624 | –1.2 |

| Current assets 1) | 213,036 | 164,483 | 48,553 | 29.5 |

| thereof cash and cash equivalents | 30,811 | 16,963 | 13,848 | 81.6 |

| Assets | 5,477,074 | 5,493,145 | –16,071 | –0.3 |

| Equity | 1,765,672 | 1,815,132 | –49,460 | –2.7 |

| Other non-current liabilities 2) | 2,566,391 | 2,754,453 | –188,062 | –6.8 |

| Other current liabilities 2) | 1,145,011 | 923,560 | 221,451 | 24.0 |

| Equity and Liabilities | 5,477,074 | 5,493,145 | –16,071 | –0.3 |

- Including assets held for sale

- Including financial liabilities from partnerships

The decline in long-term assets (–TEUR 64,624) is mainly due to the decrease in owner-occupied property, plant and equipment (–TEUR 140,936), compared to an increase in investment property (+TEUR 53,800) and contract assets (+TEUR 32,786).

In the 2022 fiscal year, Munich Airport’s liquidity reserves remained at the level of the previous year (TEUR 31,983; previous year: TEUR 34,984). As traffic recovered, trade receivables also increased to TEUR 80,101 (previous year: TEUR 42,794).

The change in equity to TEUR 1,765,672 is mainly due to the consolidated net loss for the current fiscal year (TEUR 58,794).

Further loan repayments will be due in the 2023 fiscal year. This has resulted in the shifting of financial liabilities from non-current to current. The total balance of the current liabilities at the reporting date was TEUR 399,899 (previous year: TEUR 172,673).

Capital structure

in TEUR

| Change | ||||

|---|---|---|---|---|

| Dec. 31, 2022 | Dec. 31, 2021 | Absolute | Relative in % | |

| Subscribed capital | 306,776 | 306,776 | 0 | 0.0 |

| Reserves | 113,819 | 90,083 | 23,736 | 26.3 |

| Other equity | 1,345,057 | 1,418,253 | –73,196 | –5.2 |

| thereof profit or loss for the year | –58,794 | –261,296 | 202,502 | –77.5 |

| Non-controlling interests | 20 | 20 | 0 | 0.0 |

| Equity | 1,765,672 | 1,815,132 | –49,460 | –2.7 |

| Financial liabilities from interests in partnerships | 382,357 | 348,177 | 34,180 | 9.8 |

| Shareholder loans 1) | 512,794 | 523,255 | –10,461 | –2.0 |

| Fixed-rate loans | 1,707,533 | 1,591,512 | 116,021 | 7.3 |

| Floating-rate loans | 464,692 | 514,238 | –49,546 | –9.6 |

| Loans | 2,172,225 | 2,105,750 | 66,475 | 3.2 |

| Derivatives | 438 | 1,297 | –859 | –66.2 |

| Other liabilities | 643,588 | 699,534 | –55,946 | –8.0 |

| Financial liabilities | 3,711,402 | 3,678,013 | 33,389 | 0.9 |

| Equity ratio | 32.2 % | 33.0 % | ||

- including deferred interest

The equity ratio decreased mainly due to the result for the fiscal year.

The main terms of Munich Airport’s current and non-current financial liabilities can be found in the table below:

Non-current loans conditions

as of Dec. 31, 2022

| Interest rate in % | |||||

|---|---|---|---|---|---|

| Method of funding | Currency | Interest rate | Residual debt in TEUR | from | in |

| Financial liabilities from interests in partnerships | EUR | Earnings-based | 382,357 | – | – |

| Shareholder loans | EUR | variable/earnings-based | 491,913 | Base rate plus margin | |

| Loans | EUR | Floating-rate | 466,080 | 3M and 6M-EURIBOR plus margin | |

| Loans | EUR/USD | Fixed-rate | 1,708,732 | 0.16 | 2.7 |

The shareholder loans are available for an indefinite period and bear interest at the prime rate plus a margin.

The loans are subject to the usual non-financial covenants, including pari passu declarations. In addition, there are other general conventional agreements concerning repayment in the event of changes in shareholder structure. No financial covenants have been agreed.

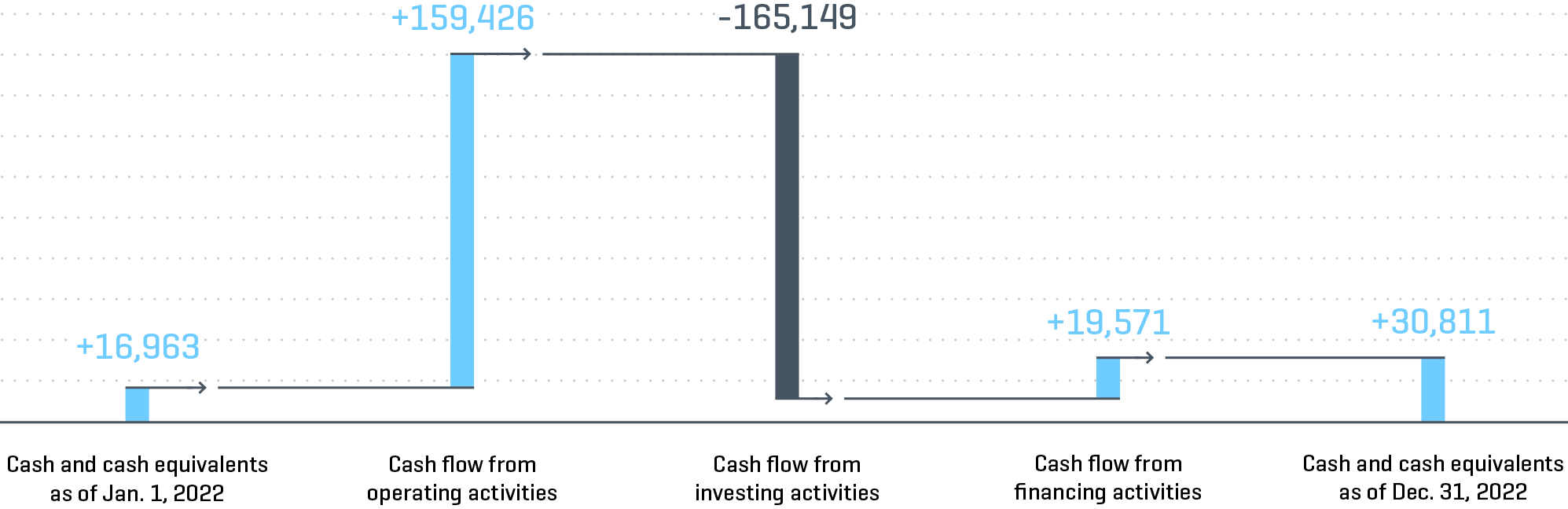

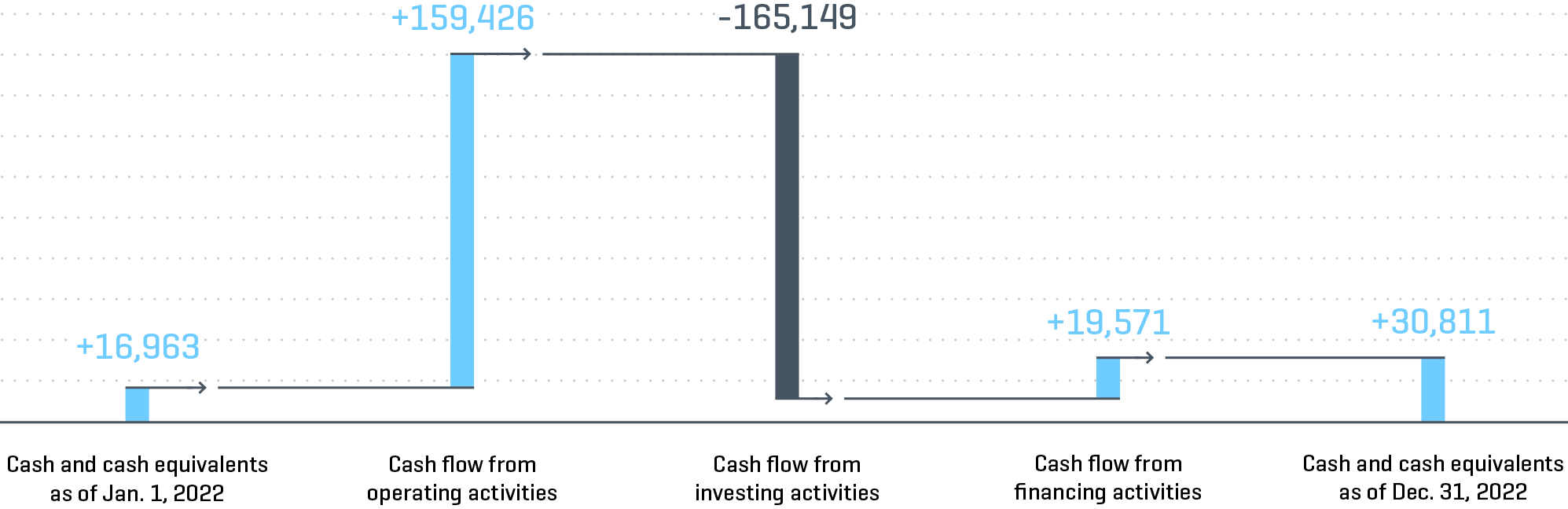

Liquidity

Due to the improved traffic and strict cost management, the cash inflow from operating activities once again increased in the 2022 fiscal year, following a cash outflow from operating activities in the previous year (–TEUR 45,819).

The cash outflow from investing activities resulted primarily from investments in construction projects. Compared to the previous year, the cash inflow from financing activities decreased by TEUR 229,094 to TEUR 19,571, mainly because of the lower level of long-term borrowings to secure liquidity.

Statement of cash flows

in TEUR