Course of business

Key events in the past fiscal year

Upward trend despite geopolitical and economic turbulences

The financial year was characterized by geopolitical and economic turbulences, particularly the war in Ukraine and its effects around the globe. Despite intensive efforts in the fight against coronavirus, the pandemic continued to cast its shadow over global economic growth.

Despite the continued travel restrictions and the difficult economic environment, the recovery in travel volumes was quite significant in 2022, with massive growth in all areas. Nonetheless, volumes did not return to the levels of 2019.

In order to counteract the continuing low earnings figures and secure liquidity, the countermeasures initiated in 2020 were continued in the Group, in both the expenses and investments. With strict cost management, the operating loss continued to be reduced in 2022.

Erdinger ring closure gets closer

With respect to the rail connection Freising‑Airport‑Erding, Deutsche Bahn began with the construction of the section from the airport to Schwaigerloh in November 2022. The new double‑track and electrified section, which is supposed to go into operation in 2025, connects to an approximately 1.8 kilometer long tunnel on the east side, which Munich Airport has already built at its own expense.

LabCampus – First office building goes into operation

91 Situated in the western part of the airport over an area of 500,000 square meters, LabCampus will consist of an innovation center that is supposed to pave the way for cross‑industry technological developments as an international meeting place for companies, start‑ups and research institutions. The first office building was completed at the end of October 2022.

Full focus on Munich location

The Munich Airport has concentrated its business activities on the Munich location; in accordance with the strategic re‑alignment, it discontinued its activities in Berlin and Hamburg at the end of 2022. The «off-campus business» will only be continued in the main focus areas Airport Management, Consulting and Training.

Traffic figures Munich Airport 1)

| Change | ||||

|---|---|---|---|---|

| 2022 | 2021 | Absolute | Relative in % | |

| Aircraft movements | 285,028 | 153,097 | 131,931 | 86.2 |

| Passengers (in millions) | 31.7 | 12.5 | 19.2 | 153.2 |

| Airfreight throughput (in tonnes) | 258,857 | 166,713 | 92,144 | 55.3 |

| Airmail throughput (in tonnes) | 7,921 | 6,594 | 1,327 | 20.1 |

- Deviations possible due to rounding

Aviation business

Recovery of traffic volumes after the second Corona year

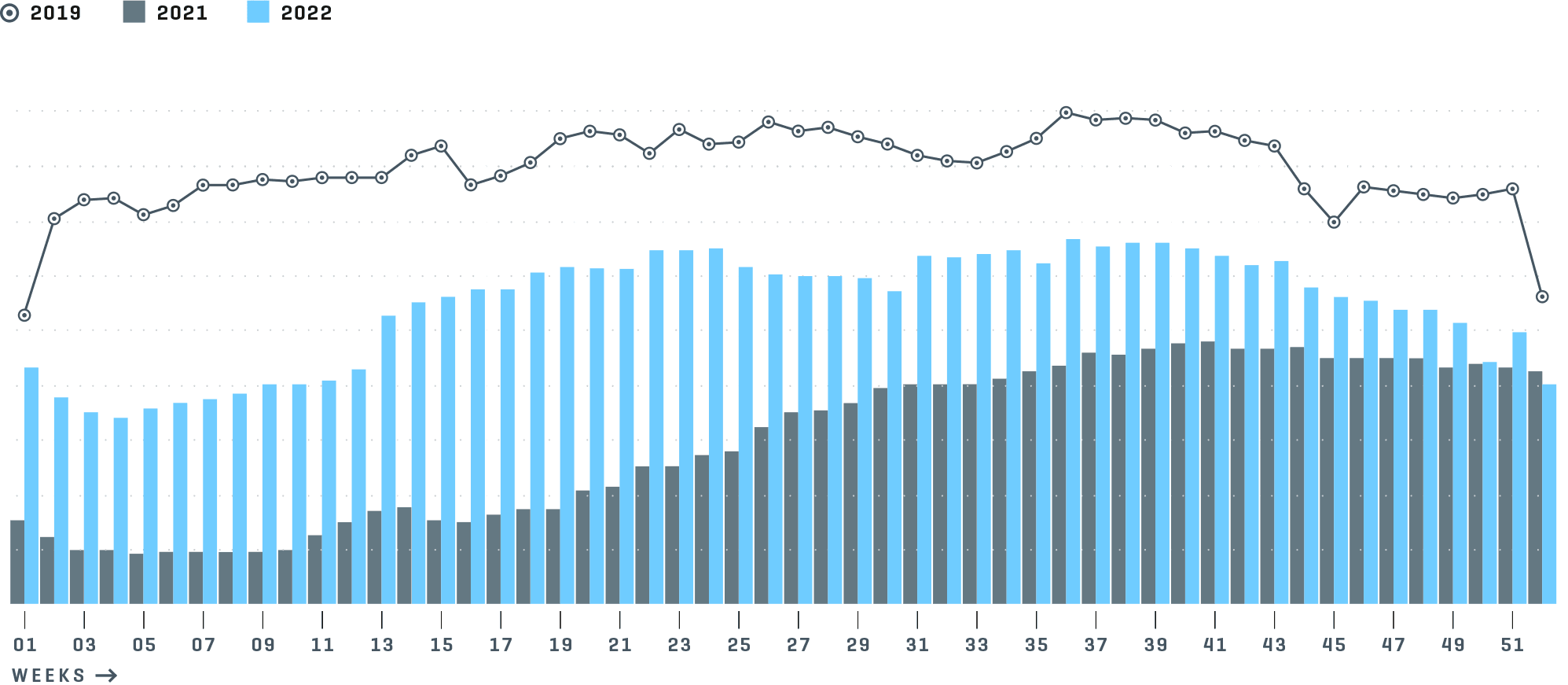

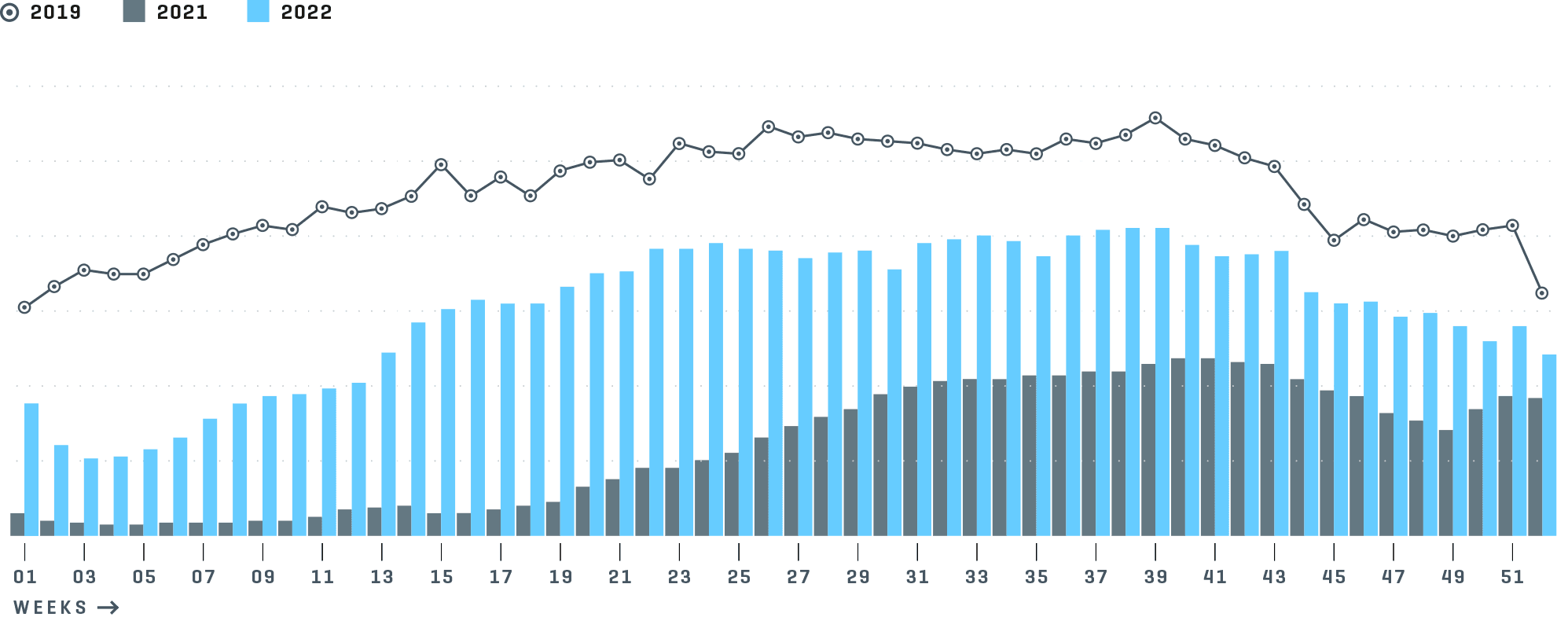

With 31.7 million passengers (+153.2%) and 285,028 aircraft movements (86.2%), Munich Airport experienced at times triple-digit growth compared to the previous year. Still, passenger volumes and movements were 66% and 68% of the values in the 2019 reference year, respectively.

Munich Airport started the year 2022 at a much higher level than in the previous year. A recovery trend, which was already noticeable during the Easter holidays, continued to gain traction as of Whitsunday. Extremely high utilization rates combined with high prices demonstrated that it was sometimes difficult to keep pace with demand.

Thanks to the wide-spread lifting of global travel restrictions, long-haul traffic returned at the start of the summer flight schedule. As of the second quarter, some destinations (e.g. US) even sur-passed the 2019 levels, while traffic into Asia continued to lag due to China’s zero covid policies. In 2022, almost 5.4 million commercial passengers were transported in the long-haul segment (+368% compared to the previous year, but 36% lower than in 2019).

In 2022, almost 4.8 million commercial travelers were transported within Germany (+110% compared to the previous year, but 50% lower than in 2019). Over the course of the year, domestic traffic continued to recover, mainly as a result of growing demand in the business travel segment, despite high ticket prices.

Similarly, the lifting of travel restrictions had an immediate positive effect on traffic volumes in the continental transport segment. Approximately 21.4 million commercial airline passengers used the Munich Airport (+137% compared to the previous year). However, passenger volumes were still 28% lower than in 2019.

Traffic in Munich picked up considerably with the start of the 2022 summer flight schedule. After two years of the pandemic and great economic uncertainty, passenger demand proved to be resilient. This development was supported by the resumption of hub traffic by Lufthansa. Connecting passenger traffic in Munich reached 43% (2021: 36%, 2019: 38%), with a high capacity utilization of 77.5% (2021: 65%, 2019: 77.5%). This figure was higher than the previous record achieved in 2018. Another remarkable development was the performance from June to September 2022 compared to the reference period in 2019: connecting passenger volumes reached 47% (2019: 33%) and capacity utilization topped out at 76% (2019: 73%).

With regard to growth rates, the airfreight segment was a bit lower but still improved its result by 55% to reach 258,857 tonnes in commercial airfreight throughput. As the long-haul passenger segment improved, bellyhold cargo volumes handled increased by 107% compared to 2021 (195,557 tonnes; –32% compared to 2019). The share of bellyhold cargo out of the total freight volume increased to 75%, which was almost as high as the level normally seen before the crisis (around 80%).

Airmail throughput grew to approximately 7,921 tonnes (+20%), but still remains 57% below 2019 results.

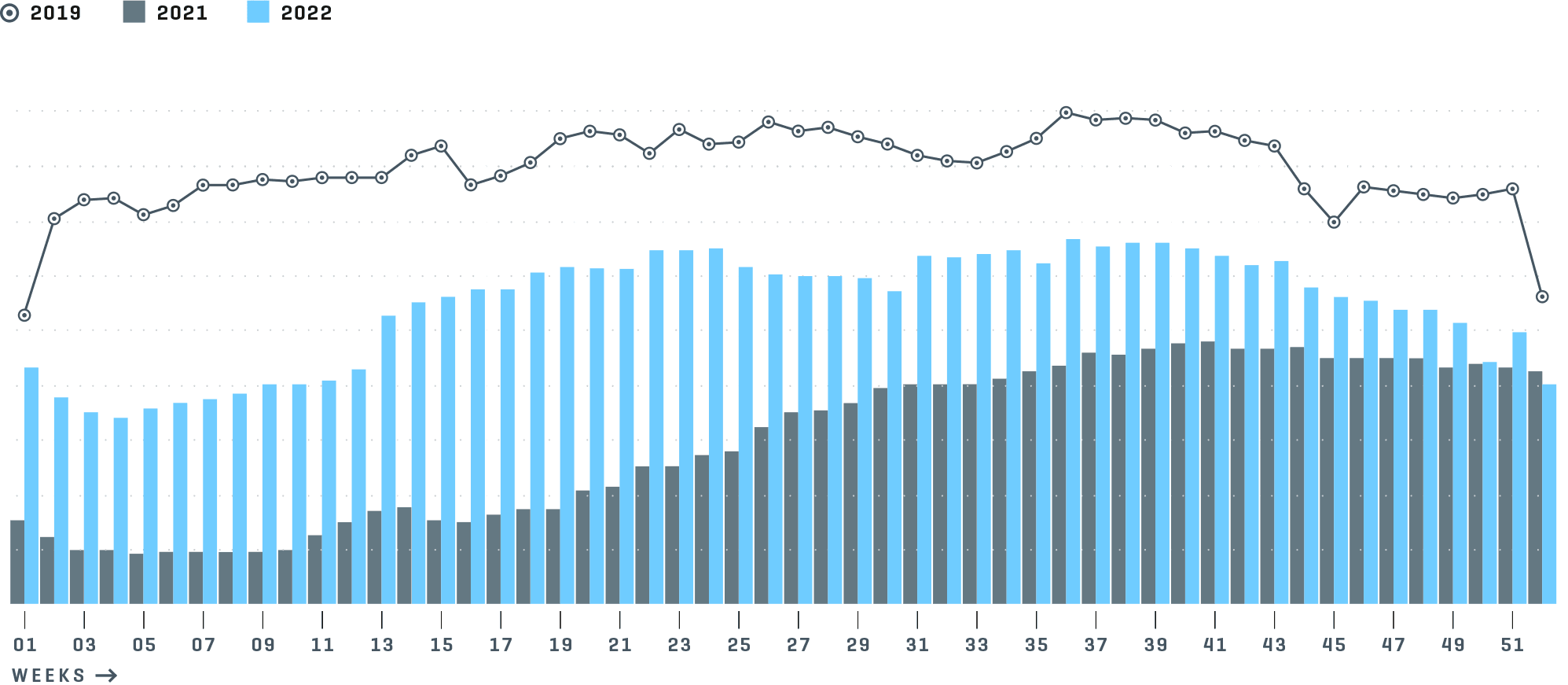

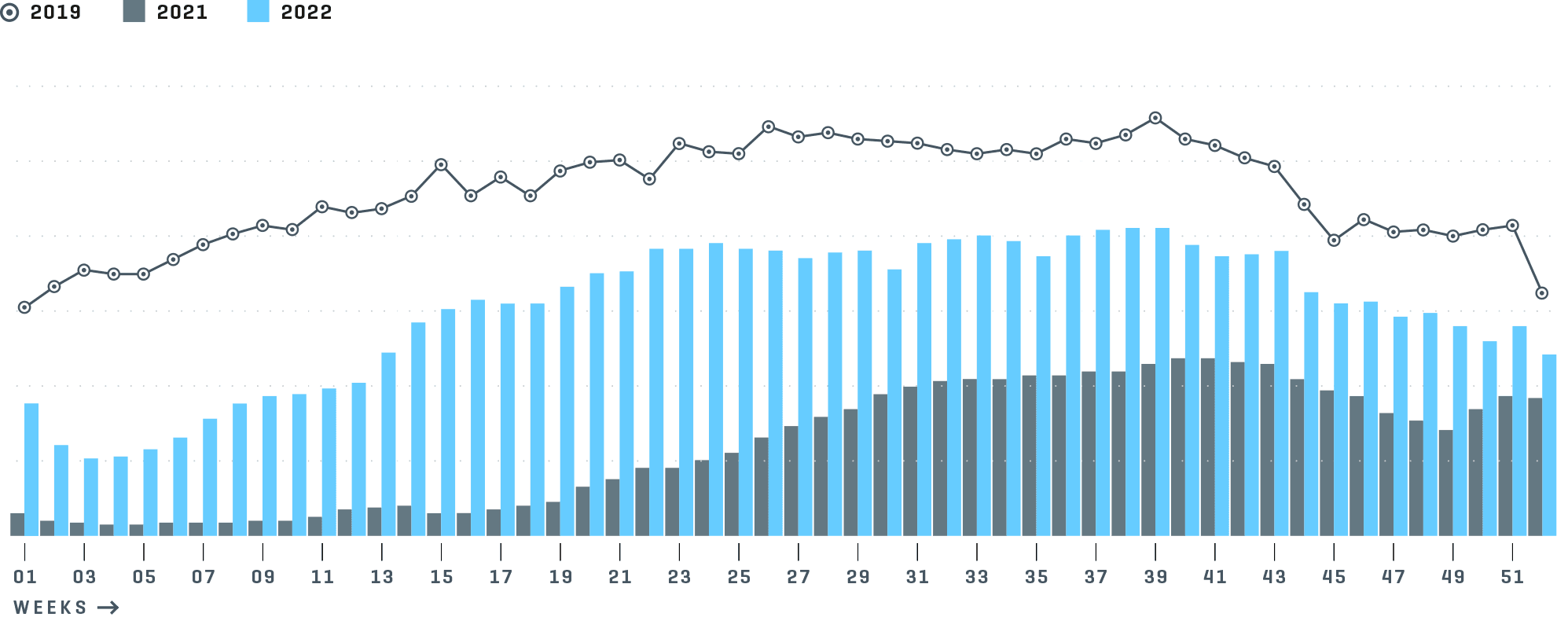

Aircraft movements at Munich Airport during the year (commercial traffic)

Aircraft movements per calendar week

Compared to the airports organized in the ADV, Munich Airport saw higher-than-average growth in 2022 compared to the previous year (also due to the resumption of hub traffic), both in terms of movement and airfreight volumes. Significant catch-up effects and the growing strength of the location were noticed particularly in the airfreight segment. As the passenger hub traffic recovered, bellyhold cargo also increased along with continued high levels of freight-only volumes.

Traffic 2022 1)

in %

| ADV | Munich | |

|---|---|---|

| Movements (total traffic) | +41.2 | +86.2 |

| Airline passengers (commercial traffic) | +110.0 | +153.2 |

| Cargo (airfreight and airmail and transit) | –6.6 | +51.0 |

- ADV, ADV Monthly Statistics 12/2022

Passenger development at Munich Airport during the year (commercial traffic)

Passengers per calendar week

The ranking of European airports with the highest passenger volumes has undergone extreme upheavals since the start of the pandemic, not to mention the impact of the Russian attack on Ukraine. At the same time, the result of the ACI analysis promptly returned to normal as the coronavirus travel restrictions were lifted. Measured by 2022 passenger volume and aircraft movements, Munich holds the 9th and 8th place in the ranking of European airports with the highest traffic volumes. All Russian airports, which still played an important role in the previous year, fell out of the Top Ten in both statistics. 19)

Ground handling services in a difficult economic environment despite recovery

The two subsidiaries AE München and AE Berlin (sold on 31 December 2022) increased their handling numbers in 2022. This development was mainly due to the continued recovery in air traffic. However, the war between Russia and Ukraine had the opposite effect.

There are two ground handling licenses at Munich Airport. One of these is permanently assigned to AE München. In 2022, AE Munich recorded an increase in handling volumes of 116.4%. Market share increased by 5.6 percentage points to reach an average of 60.7% in 2022.

AE Berlin handled 26,642 turnarounds in the reporting year (2021: 17,661 turnarounds). Compared to the previous year, the market share at the Berlin location declined to 39% in the passenger traffic segment (2021: 43%) and increased to 22% in the freight traffic segment (2021: 18%). The decrease in market share in the passenger traffic segment is mainly due to customers switching to other ground-handling service providers. Another reason is the suspension of flights by Russian airlines to Berlin.

Commercial Activities business

Compared to the previous year, sales revenues in the Commercial Activities segment increased as passenger volumes recovered. Until the end of February, the satellite of Terminal 2 was only open for US connections due to low passenger numbers. It was fully opened on 1 March, although retail and gastronomy units were not required to start operations until the middle of the year.

In the 2022 fiscal year, there were no more restrictions on retail and gastronomy units due to the coronavirus pandemic (e.g. ordered closures). In the first six months of the year, a limited operating requirement applied to the core areas between 7:30 a.m. and 4 p.m.; it was returned to the contractual operating requirement (i.e. the status before the pandemic) as of 1 August.

In order to reduce the burden on tenants and retain them at the Munich location over the long term, rents and leases were adjusted in some cases, analogous to 2020 and 2021 – primarily for passenger-dependent retail and gastronomy and differentiated according to the type and scope of the restrictions, to the extent this was legally permissible and necessary.

Retail – Revenue growth less than passenger growth

While the retail segment saw an absolute increase in revenue per passenger, this growth was not proportionate to the growth in passenger numbers – partly as a result of the terminations and insolvencies of units, but also due to the lack of wealthy international passengers from destinations such as China and Russia.

Sales revenues in the gastronomy and hotel segment are growing at a slower rate than passenger volumes

Compared with the previous year, sales in the restaurants and bars increased significantly in absolute terms and per passenger. One of the reasons is the fact that people spend more time at the airport.

The hotel recorded higher revenues due to higher demand for overnight stays and conferences. Most of the modernization measures were completed by the end of 2022. At the Skytrax Awards 2022, the five-star hotel in the central area of Munich Airport was named the best airport hotel in Europe. 20)

Parking – rise in demand, but not in line with local passenger volumes

Passenger development at Munich Airport has a strong influence on the parking business. A higher proportion of connecting passengers means that the number of local airline passengers did not increase as much as the total number of passengers. Moreover, the proportion of arrivals by car or car-sharing decreased compared to the previous year. However, since the supply of parking spots declined due to the closure of P8 parkade near the terminal, capacity utilization was high in the months when traffic was high. This resulted in high average revenues. Overall, sales revenues generated by the parking business, which is dependent on traffic, did not grow in proportion with local passenger volumes. Revenues in the rental car business increased due to the shortage of vehicles and the resulting increase in prices for rental cars.

The tenant parking business, which is not directly passenger-dependent, remained virtually unchanged.

Advertising – challenging market environment

Advertising revenues at the airport rose in line with the industry trend and the recovery of passenger numbers in 2022. This development is mainly due to the digital advertising space in T1, which was in high demand and some of which was only available as of September 2021. In T2, the increase is due to the re-opening of the satellite and the related advertising revenues, as well as renewed high occupancy levels in the west facade in T2. The strongest sectors in 2022 were automobile, airlines and technology.

Real Estate business

Ongoing site and real estate development

Overall, the result in the real estate segment has stabilized. Both rental income and ongoing costs were more or less at the previous year’s level. The development of the innovative LabCampus project is making progress. Despite a few pandemic-related delays, the construction of the Airport Academy building and the «LAB 48» office building proceeded mostly on schedule. Consequently, «LAB 48» was accepted by the general contractor at the end of October 2022.

Munich Airport is currently building a new pier at Terminal 1. The extension, which was made necessary as a result of a changed traffic infrastructure, will improve the handling quality for jumbo jets and will also be more convenient for non-Schengen passengers. With the new pier, the handling quality in Terminal 1 can once again meet the demands of passengers, airlines and authorities.

The overall concept includes a structure on three levels, comprising a core building adjacent to Terminal 1 and a pier. This will be connected to the existing Modules A and B and extend some 320 meters into the western apron of Munich Airport. Up to twelve aircraft will then be able to dock at the pier. The total area of the extension including renovations in the existing arrivals area B is around 95,000 m². For the most part, the planning process and construction works are proceeding smoothly, therefore the original target date of mid-2026 for the opening of the new pier remains in place. The insertion of connecting bridges was successfully completed in summer 2022; at this time, the facade including sun protection and the roof are being completed. Currently, the entire interior construction is in the process of being awarded, with work expected to start during the course of 2023. The current arrival module B will probably be remodeled starting in the first quarter of 2023.

The «FMG and Housing» project will be continued in the long term as an HR marketing tool, but in the short term, apartments and rooms will be marketed to external parties due to low demand, in order to minimize the deficit.

The modernization measures at the Hilton Hotel are progressing: the conversion of the restaurant, the east wing and the atrium access points were completed in 2022; the west wing was updated at the beginning of 2023.

A technology hub will have to be established to meet future requirements such as the «Internet of Things», building automation, and also for housing and hosting the IT Governance. Construction for this building in AirSite West started in September 2022, with a planned opening date of August 2023.

The parking space strategy demonstrates the urgent need to create additional parking space on the airport area. Parkade P8 (capacity of approximately 3,700 parking spaces) is currently in planning to meet demand for parking lots in the central zone. Construction is slated to begin in 2023, with a completion date of 2026. This parkade will also be the ideal complement to the mobility center, which is also being planned.

Moreover, parking capacities in AirSite West are being adjusted to demand. While parkade P44 with 2,000 parking spaces already opened in 2021, the directly adjacent parkade P43 (1,800 spaces) is currently under construction. It is set to open in the first quarter of 2024.

Expanding its location at the Munich commercial airport, logistics company DHL is building a new Express Center in the vicinity of the current parking lots P80 and P80 West at its own expense. To this end, FMG leases a parcel of approximately 19,000 m² and also assumes the development costs as well as the coordination regarding the Critical Part interface. Construction started in August 2022, with a planned completion date in the second quarter of 2024.

- ACI-2022-Munich Airport Ranking in Europe.pdf

- SKYTRAX, World’s Best Airport Hotels 2022, November 2022