Opportunities and risks report

Opportunities

As an international aviation hub, Munich Airport competes with other major commercial airports. Functional and targeted opportunity management is of central importance for maintaining and expanding the airport’s market position. This is an integral part of the strategy and planning processes at Munich Airport. Opportunities are future developments and events that may lead to a positive deviation from planning or strategic targets. Both external (for example, changes in the market environment) and internal opportunities (for example, programs to increase efficiency) are considered.

All divisional heads and managing directors of the subsidiaries and associated companies are responsible for developing and implementing measures to take advantage of opportunities. In this, they are supported by the corporate divisions Finance and Controlling. In addition, all employees of the Munich Airport in the business units and their subsidiaries are generally required to identify opportunities in the course of their daily work and report them to their supervisors.

As a basic principle, Munich Airport strives to strike a balance between opportunities and risks. If it was likely – at the time of planning – that an opportunity would arise, it was already included in the 2023 forecast or in the medium and long-term planning. The opportunities presented therefore focus on future developments or events that could lead to a positive deviation for Munich Airport from the forecast and the medium and long-term planning.

The evaluation of opportunities is based on the risk assessment system. The economic benefit resulting from the opportunities and the probability of occurrence are divided into the following categories analogous to the risks under consideration:

| Economic advantage | Amount in € |

|---|---|

| Low | 1 – 5 million |

| Medium | 5 – 30 million |

| High | 30 – 150 million |

| Very high | >150 million |

| Probability of occurrence | Percentage intervals |

|---|---|

| Very low | 5 – 10% |

| Low | 10 – 25% |

| Medium | 25 – 50% |

| High | >50% |

In contrast to the risks, the probability of occurrence and financial impact (economic advantage) are not shown separately, but are combined in the «high relevance» and «low relevance» opportunity categories.

Since Munich Airport is confronted in some cases with very long planning periods, the opportunities are also indicated as to when they will occur in the short, medium or long-term.

| Maturity | Period |

|---|---|

| Short-term | <2 years |

| Medium-term | 2 – 5 years |

| Long-term | >5 years |

Compared to the previous year, there were no changes to the structuring of identified opportunities as of December 31, 2022. However, the content description and assessment of the opportunities has been revised.

Overview of opportunities at Munich Airport

| Opportunities | Rating | Time of occurrence | Summary of the measures |

|---|---|---|---|

| Development of the coronavirus pandemic | high relevance | short‑ and medium‑term |

|

| Market development | high relevance | short‑, medium‑, and long‑term |

|

| Rail access | high relevance | long‑term |

|

| Interest and exchange rate trends | high relevance | short‑term |

|

| Economic development | low relevance | short‑ and medium‑term |

|

| Regulation and legislation | low relevance | long‑term |

|

| Implementation of climate protection measures (CO₂ strategy) | low relevance | long‑term |

|

| Internal process and efficiency improvements | low relevance | short‑term |

|

| International business | low relevance | medium‑ to long‑term |

|

| Real Estate | low relevance | long‑term |

|

Development of the coronavirus pandemic

The travel and tourism industry was particularly affected by the coronavirus pandemic due to severely restricted mobility worldwide. Air traffic recovered noticeably with the start of the summer flight schedule, after most of the measures were lifted. At the same time, it still lags behind the levels seen before the pandemic. Some travel restrictions were still in effect in the 2022 fiscal year. Particularly the People’s Republic of China was virtually cut off from global travel until the end of 2022, as a result of the country’s zero covid strategy. Travelers are still concerned about the restrictions as well as the possibility that they may be re-introduced, which hinders demand. If the remaining travel restrictions are lifted sooner than expected, it could result in higher than expected earnings for the Munich Airport. The Group is systematically monitoring further developments and is in close contact with airlines as part of its acquisition activities. Moreover, a professional customer group analysis is performed in the retail segment, and the product portfolio is continuously adjusted to customer preferences. The aim is to offer above-average participation in a recovery.

In December 2022, the Chinese government relaxed its strict zero covid policy and lifted most of the pandemic measures. Starting in January 2023, travel restrictions were gradually lifted. It seems likely that any remaining travel restrictions put in place by other countries will also be lifted in 2023. Therefore it is quite probable that the developments as described will actually come to pass. The resulting opportunity is therefore rated as «high relevance».

Market development

Airline industry trends are of particular importance for traffic volumes at airports. The coronavirus pandemic created unprecedented challenges for the airlines. The crisis led to a reduction in personnel numbers and aircraft fleets. However, the sector has undergone a marked recovery since the summer of 2022. Not enough aircraft, along with labor shortages and the resulting handling problems at the airports, have created a situation in which the renewed demand cannot be fully met, however. In this context, the quality of handling processes will probably be a major success factor, at least in the short term. If the Munich Airport can manage the handling problems better than other European airports, it could benefit disproportionately from the future recovery. At this time, Lufthansa is reactivating large portions of its grounded fleet and plans to operate several A380 aircraft from Munich as of summer 2023. If Lufthansa decides to assign the entire remaining A380 fleet to the Munich Airport and bundles traffic at this location, it would have a higher-than-planned positive effect on passenger numbers and hence also on the company result.

At the moment, the demand is still for point-to-point traffic, particularly within Germany, while business travel is still well below the levels seen before the pandemic. Demand is hampered by high ticket prices. However, oil prices have dropped noticeably in the last few months. It is possible that in the course of the planning horizon, flight tickets could be cheaper than initially assumed. This could also mean significantly higher passenger numbers - resulting in higher-than-planned passenger growth and earnings for the Munich Airport.

Munich Airport has been pursuing intensive quality management for some time and is just one of a small number of airports worldwide to hold the status of a five-star airport. It also has an extremely attractive catchment area, both in terms of business and private travel, and has been operating a professional airline acquisition service for years. Deutsche Lufthansa is an important customer for Munich Airport. They operate a hub at the Munich location and intend to maintain it in the future. In addition, cooperation is based on joint investments and long-term cooperation agreements.

If the airline market recovers more quickly than expected, and if the Munich Airport is able to expand its share of the recovery, it would lead to higher-than-planned earnings in the short and medium term. Although such a scenario is uncertain due to the current situation, the resulting opportunity must be rated as «high relevance» due to its impact on the subsequent development of the company.

Rail access

For some time now, the EU in particular has been calling for the various modes of transport to be interlinked as efficiently as possible, thus conserving resources. To this end, it makes sense to optimally connect the major European hub airports in particular to the rail infrastructure. In connection with the intensively conducted climate protection debate, this topic has gained momentum in recent years.

With regard to the rail link to Munich Airport, several projects, including the Erding ring closure, the Walpertskirchen Interchange, the second main line in Munich, and the Munich-Mühldorf-Freilassing/Salzburg Line 38 extension, are currently being planned or implemented. Should an adequate connection to the long-distance rail network also be established, Munich Airport could be efficiently integrated into a future multimodal transportation system. This would expand the passenger catchment area and consequently result in a higher-than-planned development of earnings.

Munich Airport has the necessary expertise on this subject and is in intensive contact with regional and national authorities as well as with Deutsche Bahn. The goal here is to realize an optimal connection of the airport to the long-distance rail network, which would bring a considerable economic advantage. The resulting opportunity must be rated as «high relevance» in the long term.

Interest and exchange rate trends

Favorable interest rate and exchange rate trends may have a positive impact on the Group’s financial result. Thus, currency effects from the conversion of earnings not denominated in euros into the Group’s functional currency (euros) may have a positive impact on the financial results.

In the retail business at Munich Airport, international customers (outside the euro zone) play a special role due to retail spending, some of which is significantly above average. Internal analyses have shown that fluctuations in exchange rates have a significant impact on retail revenues. A continued low euro compared to the relevant foreign currencies therefore offers the potential for earnings that exceed targets.

Interest rates are much higher than in the previous year; Munich Airport’s planning therefore assumes continued high interest rates for variable-interest loans. However, if interest rates decline again during the planning period, it would have a positive effect on the Group’s EBT.

Altogether, the opportunity arising from interest rate and exchange rate trends must be rated as «high relevance» in the short and medium term due to the current crisis situation.

Economic development

There is a close correlation between national and global economic growth and the growth in air traffic. In 2021, the global economy quickly rebounded from the 2020 downturn brought on by the pandemic. However, the global containment measures also disrupted global supply chains, which led to shortages of essential primary products. The outbreak of war in Ukraine during the first quarter of 2022 escalated this situation and also drove up energy prices and production costs. The economic recovery faded as economic uncertainty increased. At this time, supply shortages in energy, raw materials and primary products put pressure on the global economic situation and drive up inflation. Rising interest rates also put a damper on investment activity. Private consumption has also declined as a result, which will probably have a negative effect on demand for vacation travel. Moreover, the difficult situation that companies find themselves in also jeopardizes the development of business travel. At the same time, there has been a significant drop in energy prices recently. Some countries, including Germany, have also taken fiscal measures to counteract the historically high inflation rates.

The reversal of the strict zero covid policy can also contribute to the swift recovery of supply chains. As a result, inflation forecasts have improved recently. The International Monetary Fund (IMF) expects that the global economy will be able to cope with the impact of the war in Ukraine and continued inflation somewhat better than initially feared. If the supply difficulties resolve quickly and inflation is not as bad as expected, there is a chance that the economy will recover more quickly and air traffic will grow as a result.

Protectionist trade policy tendencies have been observed in various countries in recent years. Since air traffic volumes are strongly dependent on the degree of globalization of the world economy, protectionist measures generally have a slowing effect on global air traffic. If these trends reverse in the following years and there is a renewed political focus on the global distribution of labor, it could boost economic and air traffic growth.

Different divisions of Munich Airport intensively monitor all relevant economies worldwide. In this way, potential for the various business units (e.g. Aviation and Commercial Activities) is identified and appropriate measures are initiated to exploit opportunities on a decentralized basis.

Even though economic growth is one of the main factors affecting air traffic, it is not expected that short-term economic growth will be significantly higher than the current forecasts. The resulting opportunity must therefore be rated as «low relevance».

Regulation and legislation

Air transport has historically been a highly regulated market. Accordingly, laws, ordinances and international agreements are still a decisive factor influencing air traffic today. The introduction of new regulations, as well as changes to existing ones, may involve risks, but also present opportunities for market participants.

In 2011, the German government introduced a ticket tax in the form of the German aviation surcharge, which was increased on April 1, 2020. The surcharge is used to implement climate policy objectives. Due to its national character, the German air traffic surcharge has competition-distorting effects in the European air traffic market. As a result, air travelers from areas close to borders are increasingly choosing airports abroad as their departure point. If the aviation tax were to be replaced by more effective international climate policy instruments, this could reduce the competition-distorting effects. And this could lead to an increase in traffic at Munich Airport.

In the wake of the current crisis, the discussion on the creation of a Single European Sky gained momentum. In addition to the introduction of uniformly high safety standards, the goal is to expand airspace capacity and achieve more economical supranational cooperation between the national air traffic control organizations. In concrete terms, the goal is, among other things, to enable airlines to operate more economical flight routes (direct air route). More efficient flight routes could lead to significant kerosene savings and thus reduce CO₂ emissions (by up to 10%). While the latter could bring a positive image boost for air travel as a whole, the former would have a positive impact on demand for air travel due to lower costs. However, Single European Sky is an extremely complex issue, since it involves questions of national sovereignty of the individual European states. Accordingly, possible solutions must be developed by all national and European players in dialog with industry.

In order to properly utilize opportunities arising from regulation and legislation, Munich Airport maintains a Corporate Communications and Politics department and is involved in various aviation associations, such as the BDL. The central objective here is to help shape important regulations for the aviation sector and counteract competition-distorting effects.

In summary, the opportunities arising from regulation and legislation are currently rated as «low relevance» due to the low probability of occurrence.

Implementation of climate protection measures

Munich Airport is pursuing the climate target of «CO2-neutrality by 2030». It will reduce the CO2 footprint it can control to zero through a combination of reduction and offsetting measures. The implementation of this CO2 strategy is associated with costs. In the field of energy generation and conservation as well as renewable energies, a progressive increase in efficiency can generally be observed. If this development accelerates, the cost of CO2 neutrality at Munich Airport could fall below the expected level. The environment, technology, and strategic sustainability management departments at the airport monitor trends in this direction.

In the long-term, this could lead to higher than expected earnings. Despite changing political incentive and/or sanction mechanisms, the resulting opportunity is rated as «low relevance» due to the comparatively low earnings outcome effect.

Internal process and efficiency improvements

The impact of the coronavirus pandemic prompted Munich Airport to launch the «Restart» change program. The program served to make the company viable and efficient for the future. The measures of the program were implemented in the course of 2021. Since the economic effects have already been taken into account in Munich Airport’s medium-term planning and ambitious targets have been assumed, the likelihood of a performance that is significantly greater than planned can be classified as low. The resulting opportunity is therefore rated as «low relevance».

International business

Munich Airport’s international business could develop better than expected.

After the pandemic, the macroeconomic environment will recover and demand for consulting and management services will increase again. In the medium term, the further acquisition of airport-related consulting firms and new strategic partnerships could also strengthen the local market position of the international business in important target markets. On the one hand, this could ensure faster market entry, local networks can be adopted, and local personnel cost structures can be established. On the other hand, acquisitions can complement the product portfolio and thus strengthen competitiveness.

Current developments also reveal a global trend where private companies are increasingly involved in the management and operation of airports, which were previously managed by the government. For the international business, this development means more financially advantageous project opportunities that could be realized in the context of the applicable corporate law and strategic requirements.

To this end, the Group closely monitors all relevant markets and developments, conducts professional customer acquisition, and continuously adapts its product and service portfolio to market requirements. In this way, opportunities that arise can be optimally exploited.

In the medium and long-term, this could lead to higher than expected earnings. However, the resulting opportunity must be rated as «low relevance» due to the comparatively low earnings effect.

Real Estate

The current major economic and ecological challenges are putting companies in the Federal Republic of Germany under high pressure to innovate and collaborate. Moreover, major changes are also occurring in the labor market, which will require a rethinking with regard to the future configuration of workplaces. This could lead to an expanded need for cooperative sites and test sites.

With its «LabCampus» project, Munich Airport is creating a new type of innovation center that provides lease premises and that focuses on cross-sector collaboration, joint development, testing, presentation, and realization. Projected earnings may be exceeded if the LabCampus is completed more quickly and additional buildings and other clusters generate earnings earlier than forecast.

The Group keeps a close eye on all relevant markets and conducts professional customer acquisition activities in order to make the best possible use of opportunities that arise in the market. The resulting opportunity is currently rated as «low relevance» due to the long-term impact horizon.

Risk management system

The Executive Board of FMG and all subsidiaries and affiliated companies is responsible for the early detection and prevention of risks that jeopardize the continuity of Munich Airport and the investments. Group Management has overall responsibility for an effective risk management system and lays the essential foundation for it by communicating and defining corporate strategy and targets. It formulates specifications for the risk management process and the organizational structure of the risk management system.

The goal of the risk management system is to identify events and developments that may have a negative impact on the achievement of strategic and operational targets in good time and develop suitable countermeasures. All dimensions of the business activities are taken into account.

The risk management guideline regulates the general principles of risk management in the Group as well as the tasks and responsibilities of the function holders involved in risk management on the basis of the internationally recognized framework model «COSO ERM» (Committee of Sponsoring Organisations of the Treadway Commission – Enterprise Risk Management).

The Risk Management Committee, which reports directly to the Executive Board, serves as an additional supportive management, control and supervisory body. It consists of the entire Executive Board, the heads of the Aviation, Commercial Activities and Real Estate business units, the heads of the Legal, Corporate Bodies, Compliance and Environment, Finance & Controlling, Group Security, Group Development, Corporate Communications and Politics departments, the head of IT and the Risk Manager. The head of Compliance and the Business Continuity Management (BCM) officer also participate in the committee.

The task of the Risk Management Committee is to analyze the risks from a Group perspective and to monitor the effectiveness of countermeasures. It provides support for developing the risk management system and for risk identification, assessment, and control. The Risk Management Committee meets quarterly and issues the risk report for the shareholders.

The risk management process comprises the following steps. A digital coordination and communication platform has been established to support this process.

Identification and communication of risks

All divisional managers and Chief Executive Officers of subsidiaries and shareholdings are responsible for the identification and assessment of risks. It is where all risk-relevant information is coordinated, managed, documented and forwarded. The risk manager checks the divisions’ risk reports for plausibility and compliance with the Group-wide standards for risk assessment. The role involves combining the divisions’ individual reports in a risk report, taking account of materiality for the Group, and reporting quarterly to the Risk Management Committee and the shareholders. Risks that jeopardize the Group’s existence that have been identified for the first time must also be reported to the Executive Board on an ad hoc basis.

As a basis for dealing with risks responsibly, each individual employee is involved in managing risks throughout the company. All employees are responsible for reporting risks in their department.

Assessment of risks

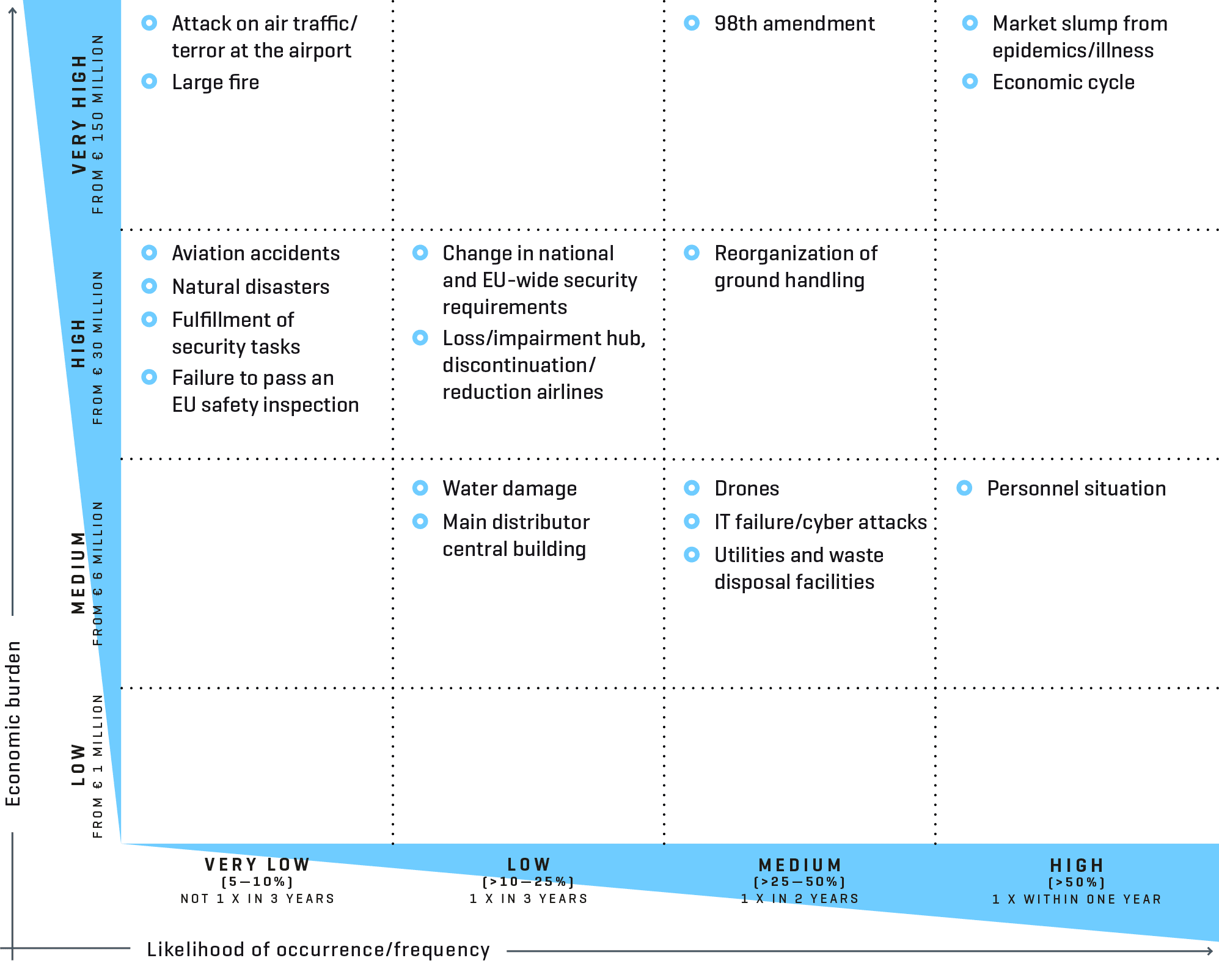

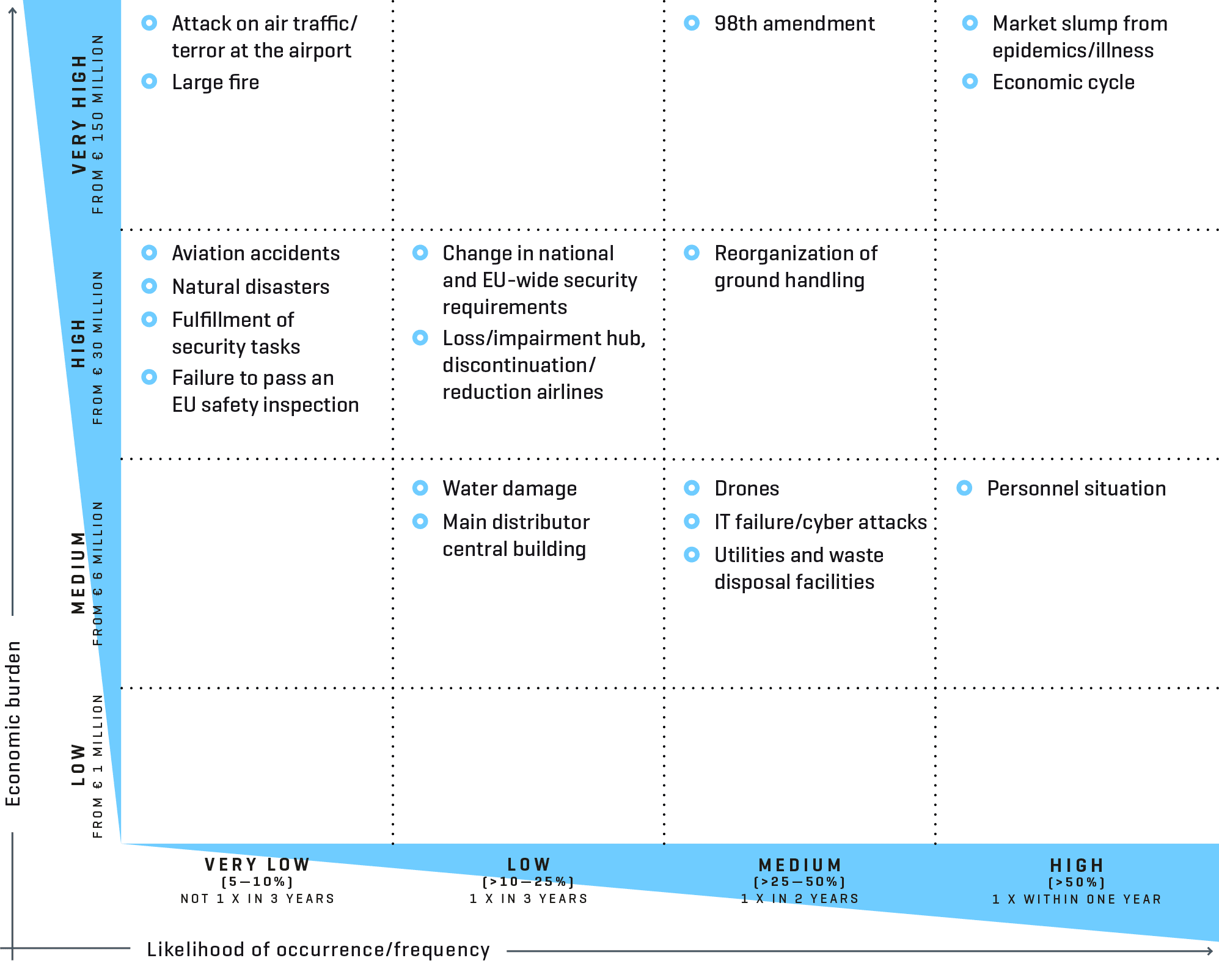

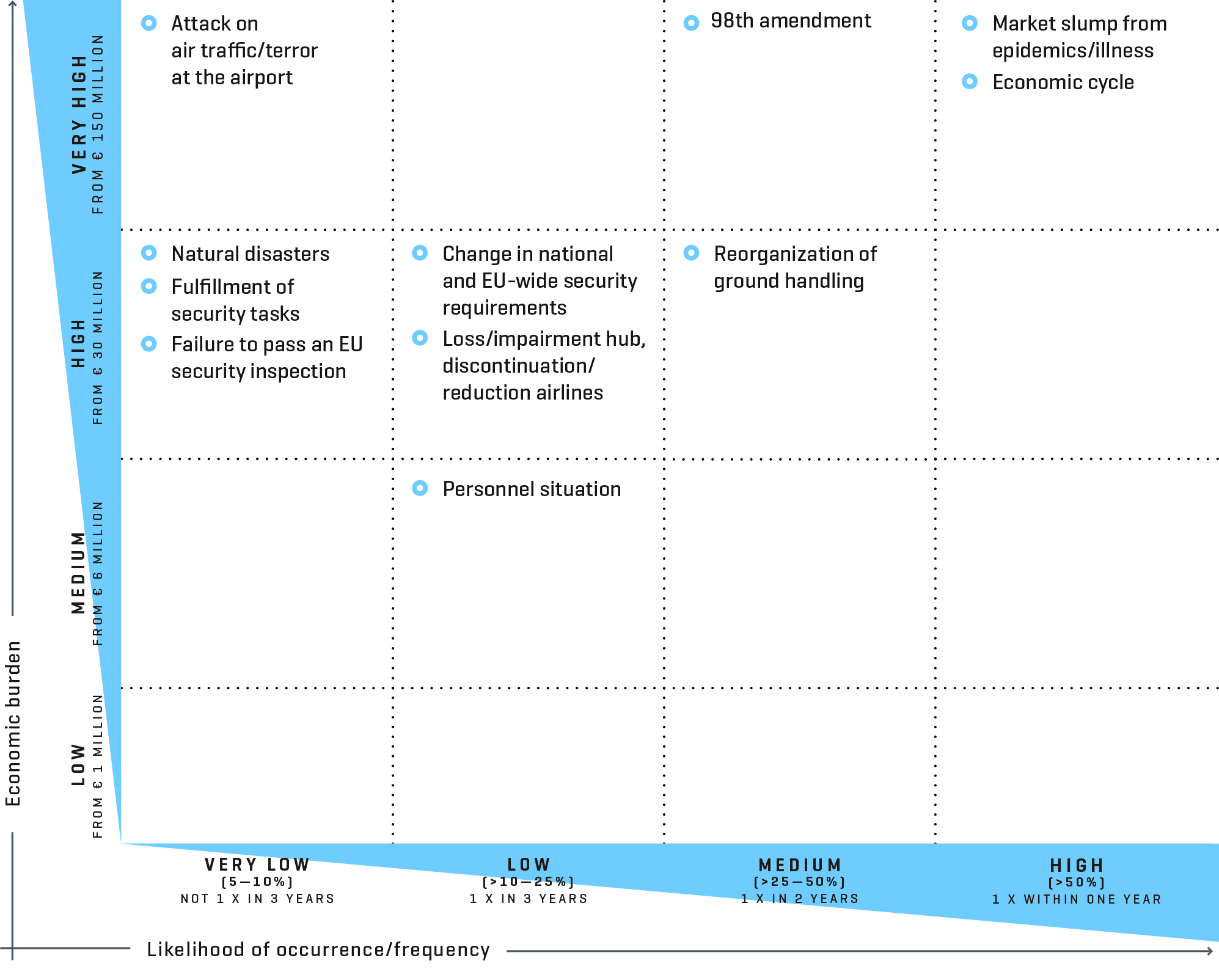

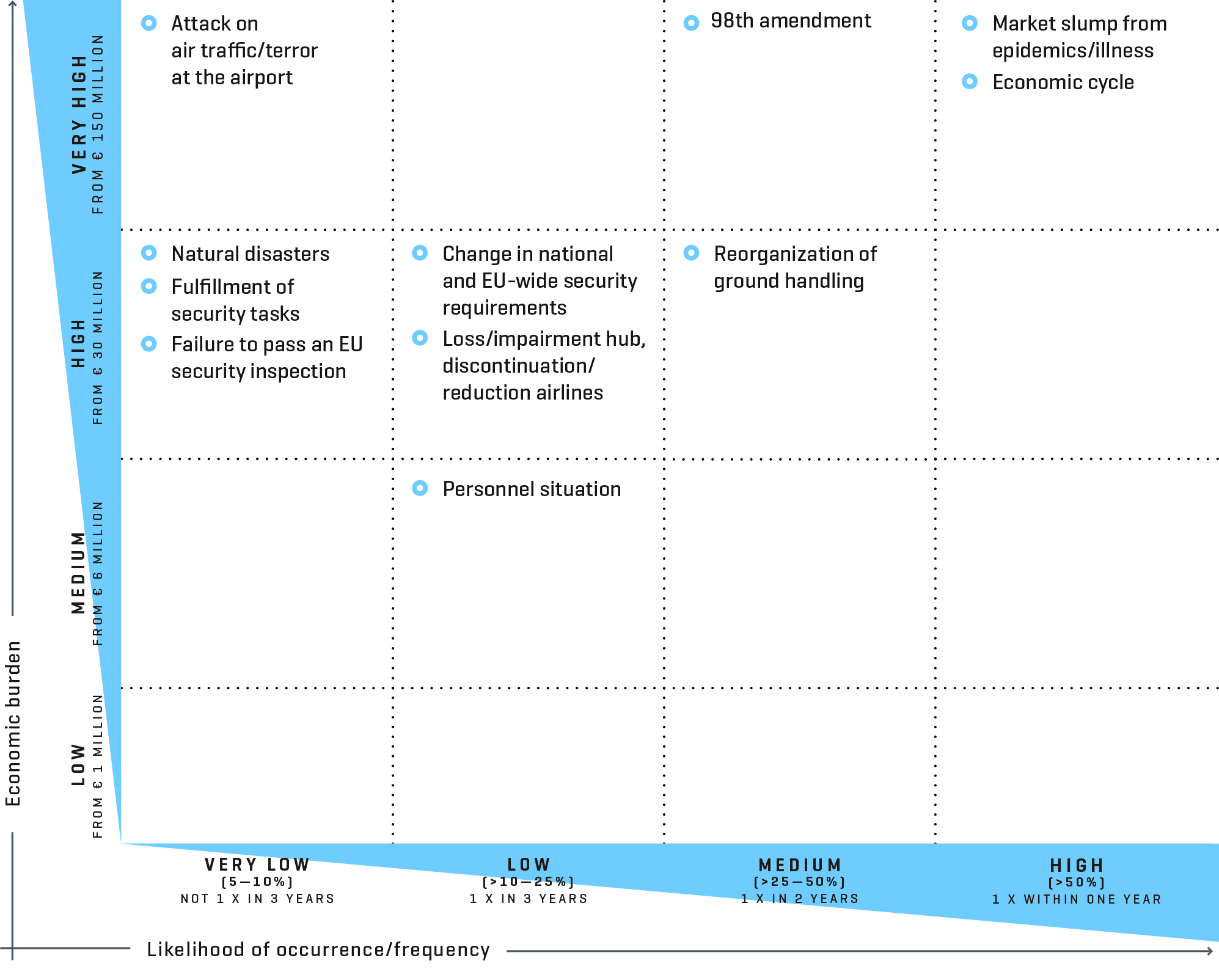

The risk assessment allows the company to determine the extent to which individual risks jeopardize the fulfillment of corporate goals and strategies and which risks may possibly threaten its existence. For this purpose, the factors damage amount and probability of occurrence/frequency are presented in a risk matrix. The expected loss describes the impact on profits that can be expected if the risk materializes. In the case of events that recur over time, the company works with the frequency with which they occur. The assessment first takes place without considering measures to limit the risk (gross risks, see the section «Risks»). Subsequently, the risks are assessed after countermeasures are implemented (net risks, see section «Risks»).

Dealing with risk

Starting from the risk analysis, appropriate countermeasures for dealing with risk are specified according to corporate strategy and economic aspects. Risk management strategies include: control, insure against, minimize, eliminate, and transfer. The risk officers have the task of specifying and implementing countermeasures to manage risks in the respective division affected.

Risk monitoring

The risk manager continuously monitors the effectiveness of risk management. Risks are also monitored separately by Internal Audit.

Compliance management system

Compliance covers compliance with all Munich Airport-related laws, specifications, and regulations, national and international rules and standards, as well as in-house rules and guidelines. To this end, Munich Airport has established a Group-wide compliance management system.

The Compliance department submits reports on the current status of the compliance management system to the Executive Board on a regular basis and to the Supervisory Board on an annual basis.

Compliance risks are also communicated as part of the risk reporting to the Executive Board and shareholders if internal thresholds are exceeded. Regular dialog takes place between Risk Management and Compliance.

On May 1, 2022, the current compliance principles were replaced with the Code of Conduct. It contains directives and principles for conduct that conforms to the values and the legislation. It applies both within the Group and vis-a-vis third parties in the national and international context.

Identifying and minimizing compliance risks

The Compliance department prepares the compliance risk analysis with input from the FMG divisions and combines it with the subsidiaries/affiliates compliance risk analyses every year. The Executive Board is informed of the results. Compliance risks are assessed in the same way as the risk management process.

The annual Compliance Report to the Supervisory Board of FMG also includes the results of the compliance risk analysis. If, despite all countermeasures taken, a risk has a high potential for damage and at the same time a high probability of occurrence, then it is examined in more detail.

After consideration of the countermeasures, no significant compliance risks remain for the year 2022.

The Executive Board addresses the issue of compliance in an ongoing process at frequent intervals, and the Supervisory Board is informed at regularly scheduled intervals.

Preventing corruption

The Code of Conduct and the Gift and Invitation Policy support management, executives and employees in behaving lawfully and ethically in the workplace. They are published on the intranet and are therefore available to all employees. In addition, the Code of Conduct refers to the observance of other internal company guidelines, such as compliance with public procurement law during procurement and procurement processes, data protection organization or information security. These ensure that processes and procedures are transparent and traceable, both internally and externally. An undertaking to avoid corruption is required during procurement and tender processes, with sanctions for violations.

The position of anti-corruption officer is exercised by the head of the Compliance department. There are no known confirmed cases of corruption in the Group for 2022.

Communication and training

A key task of the Compliance department is to train and advise employees, managers, and the FMG Executive Board as a preventative measure to stop compliance breaches from occurring.

All employees and managers are regularly familiarized with compliance documents and innovations using a flexible process (in-person or digital). Participation in the training was documented.

In order to raise awareness of compliance issues and data privacy violations, web-based compliance training is mandatory for all employees throughout the Group once a year, in addition to compliance instruction by the respective manager, and it must be successfully completed with a test. In addition, all employees must participate in web-based training for «Information security and data protection» once a year.

In 2022, an external law firm delivered five training sessions in cooperation with the Compliance department as part of the Leadership Excellence program.

Electronic whistle-blower system

Through an electronic whistle-blower system, the Business Keeper Monitoring System (BKMS®), Munich Airport employees, business partners, and customers can report behavior potentially damaging to our organization (also in English). Furthermore, documents can also be forwarded electronically in anonymized form. People inside the Group and outside can also contact the Compliance department by other means of communication (telephone, email, face-to-face discussions) if they wish to draw attention to compliance infringements and need advice. Tender documents inform potential bidders of the possibility of using the BKMS® should compliance infringements be suspected.

Data protection

Munich Airport has taken comprehensive measures to comply with the General Data Protection Regulation (GDPR) and the Federal Data Protection Act (BDSG). The subsidiaries and associated companies have appointed data protection officers to perform advisory and oversight duties in accordance with the GDPR. Data protection coordinators have also been established in FMG’s specialist departments in order to identify and address the issues and risks faced by the departments. They are continuously trained, informed, and advised by the Corporate Compliance unit in cooperation with the Data Protection Officer.

The Group-wide data privacy policy was updated with the continued aim of protecting data subjects when their personal data is processed within the Group, and ensuring compliance with data privacy laws.

Responsibility for data protection compliance in their respective processing operations is decentralized among the individual FMG departments and subsidiaries/affiliates.

FMG’s Data Protection Officer is responsible for advising and supporting the departments and is directly appointed as data protection officer in some subsidiaries/affiliates. He/she is assigned organizationally to the Compliance department and reports directly and independently to the Executive Board.

Because of the coronavirus pandemic, training and awareness-raising measures were delivered digitally; moreover, information was continually provided via the Intranet and customized advisory services were also made available.

Risks

Risks that could have a material influence on the business activity or on the assets, financial position, and results of operations as well as the reputation of Munich Airport are explained below. In each case, the risks are shown before (overview of gross risks) and after consideration of suitable countermeasures (overview of net risks).

The risk assessment relates to the economic impact in the period quoted. As of December 31, 2022, the following material gross risks were identified for Munich Airport:

Overview of gross risks

Risks resulting from force majeure

| Risk | Description and analysis | Countermeasure(s) |

|---|---|---|

| Natural disasters | Persistent and intensive rainfall together with melting snow and ground saturation to the south of Munich as far as the Alps could cause flood run-off in the Isar. A resulting breach of the Isar dams and the flood protection dikes near Freising could lead to flooding in the airport vicinity. | The Water Management Office has remeasured the Isar River. Studies have shown that the existing flood protection dikes in the airport’s sphere of influence are adequate for intense precipitation and flash floods, which can occur during appropriate weather conditions. In addition, a review of drainage safety within the airport is conducted to establish the requirements for a «Hochwasser-TÜV» (a technical inspection agency for flooding). On a permanent basis, Munich Airport monitors the wastewater discharge and carries out maintenance and repair measures. Countermeasures are being intensified at an operational level by means of crisis and risk management procedures at Munich Airport. Insurance to cover earthquakes, storms, hail, and flooding has been arranged. |

| Attack on air traffic/terror at the airport | Air traffic is subject to threats from terrorist attacks and politically motivated disruption. Aircraft and infrastructure facilities are relevant targets. In addition to bodily injury and property damage, this would result, at least temporarily, in a decrease in the number of aircraft movements and passengers. | To avert possible disruptions, Group security takes strategic, operational, and technical/organizational measures: Provision of sufficient and well-trained personnel resources, construction measures to guarantee modern and approved security technology and infrastructure, monitoring of service quality through sustainable quality measures, and constant exchange with the responsible security authorities. Bodily injury and property damage as well as interruptions of operations are insured. |

| Fulfillment of security tasks | The airline companies are responsible for security tasks in transferred areas. In these areas, airline companies fulfill the same task as airport operators, but are not subject to the same supervisory authority. For Munich Airport, there is a risk that inspections will reveal defects in transferred areas and the airport as a whole will lose its security status as a result. Defective controls could lead to property damage and bodily injury as well as reputational damage. | At present, a subsidiary of FMG is responsible for operational security tasks in the transferred areas; its services rendered are subject to regular monitoring by FMG. Furthermore, a mutual, intensive exchange takes place with the responsible government and supervisory authorities. |

| Market slump from epidemics/illness | Munich Airport is an arrival, departure, and transfer point for millions of travelers and thus a potential gateway for bacteria and viruses from all over the world. Epidemic/sickness outbreaks can result in market downturns with reduced aircraft movements and passenger numbers. | Munich Airport is subject to the Act Implementing the International Health Regulations (IGV-DG) and employs a subsidiary to fulfill the necessary functions. Likewise, the rules specified by EASA (European Union Aviation Safety Agency), which are regularly audited by the supervisory authority, are met. Examples of protective measures against infection include: touch-free access points and faucets, regular hygiene inspection tests, safety distances, and «eGates» for touch-free identification using facial recognition technology. For explanations of the economic countermeasures, please refer to the «Economic cycle» risk. |

| Large fire | In the event of damage to or destruction of terminals or infrastructure systems caused by a large fire, property damage and bodily injury as well as long-term interruptions of operations are to be expected. | To minimize the risk of a large fire, Munich Airport takes all necessary preventive and defensive fire protection measures. To this end, it operates its own airport fire department. The risk of a major fire is additionally minimized by a fire insurance policy (property and interruption of operations insurance) and public liability insurance (liability claims of third parties). After taking the countermeasures into consideration, the net risk is below the risk tolerance limit. |

| Aviation accidents | Aviation accidents or damage to aircraft can result in bodily injury and property damage, as well as interruptions of operations and secondary damage. | To minimize the risk, Munich Airport maintains an Airport Rescue and Firefighting service, a medical service, and a counseling team. The risk of aviation accidents is minimized through liability insurance and fully comprehensive insurance. After taking the countermeasures into consideration, the net risk is below the risk tolerance limit. |

Market risks

| Risk | Description and analysis | Countermeasure(s) |

|---|---|---|

| Loss/impairment hub, discontinuation/reduction airlines | Some of the transportation-related and economic impacts from the coronavirus pandemic continue to this day. At the start of the 2022 summer flight schedule, air traffic developments were already characterized by significantly higher passenger demand and a substantial expansion in airline offerings. The significant increase in connections to business centers indicates a recovering business travel sector. The continued war in Ukraine has little effect on traffic developments at the Munich location. DLH continues to reconstruct the hub at the Munich Airport and confirms its commitment to Munich by stationing its entire Airbus A350 fleet and four leased machines of the same type in Munich. In addition, Airbus A340-600 machines with First Class compartments are used for the premium segment on the relevant routes. As further evidence, DLH also announced that some Airbus A380 machines would once again take off from Munich as of the summer of 2023, in response to the strong demand for intercontinental flights. The risk of losing the hub in the short term is therefore rated as «moderate». | Munich Airport’s collaboration with DLH is based on joint investments and long-term cooperation agreements. Even in the current crisis, the intensive cooperation between FMG and DLH will continue in order to further develop the high-performance, globally renowned hub. This is also reflected in the letter of intent (Lol II) in the context of the MUC2030 project, which was signed at the end of the year. Additionally, at the «World Airport Awards», which are awarded annually by the London-based aviation research institute Skytrax on the basis of a global passenger survey, Munich Airport was awarded the title «Best Airport in Central Europe» in 2022. |

| Economic cycle | The global economy is currently on a downward trend. The pandemic and the war in Ukraine pose key risks for economic development. In the course of the war in Ukraine, western government imposed far-reaching sanctions and have restricted trade with Russia. This led to a big increase in energy prices, which declined again somewhat in the fourth quarter of 2022. Furthermore, production is hindered by disrupted supply chains, while production costs remain high. This can lead to higher inflation and a restrictive monetary policy. Similarly, protectionist and economic policies can also have a negative effect on global economic performance (punitive duties, «Buy American» program, «Inflation Reduction Act»). This may hinder growth in the transatlantic market, which is important to Munich Airport. A multi-year economic crisis, including subsequent effects, could have an acute and significant impact on FMG’s earnings and liquidity. | The reduction of expenditures by means of cost-cutting measures in all areas, socially acceptable staff reductions and a short-term cut in the investment budget in non-critical divisions have mitigated the consequences of economic slowdowns. To ensure solvency, revolving credit lines exist or loans can be taken out on the capital market. |

Operating risks

| Risk | Description and analysis | Countermeasure(s) |

|---|---|---|

| IT failure/cyber attacks | Constant new technological developments and the increasing threat of cyber attacks worldwide lead to risks in relation to the security of IT systems and networks as well as data security. In the area of cybercrime, there is an increasing, abstract potential risk that requires constant monitoring and assessment. Failure of IT for traffic operations can lead to interruptions in operations. This would result in financial losses and reputational damage. | Critical corporate IT systems are fully redundant with systems located in physically separate locations. Property damage and business interruption are covered by all-risk insurance. To avert a cybercrime attack, strategic, technical, and organizational measures are specified and monitored by an information security management system, and managers and employees receive regular training. In its own competence center against cybercrime, IT specialists at the airport work together with experienced IT security companies to develop new procedures for combating cybercrime. To reduce losses, FMG has taken out insurance against cyber risks. After taking the countermeasures into consideration, the net risk is below the risk tolerance limit. |

| Water damage | Water damage caused by a break in the main drinking water or fire extinguishing water pipelines could lead to the failure of infrastructure systems important for air traffic. | Remotely controlled emergency shut-off equipment and additional protective devices in the pipeline connections limit the possible damage. Property damage and interruptions of operations are insured. After taking the countermeasures into consideration, the net risk is below the risk tolerance limit. |

| Change in national and EU-wide security requirements | Munich Airport is subject to national and EU-wide aviation security requirements, encompassing the topics of airport security, air passenger and hand luggage checks, airfreight, airmail, and goods control, among others. Security requirements are adjusted continuously to the current circumstances. This can give rise to procedural and also infrastructural changes for Munich Airport. Corresponding financial burdens would then follow. | Munich Airport attempts to minimize these consequences through work in associations and on committees. Early information relating to ongoing legislative procedures ensures the timely implementation of security regulations. Additional expenses incurred as a result of infrastructural changes are used as the basis for the framework agreement on charges. |

| Failure to pass an EU safety inspection | The EU’s aviation authorities are conducting safety inspections at airports. Should it fail to comply with a safety standard and subsequently fail the follow-up audit, Munich Airport can lose its «Clean» status. The consequences would be a heightening of the safety regulations, considerable obstruction with operational processes, competitive disadvantages, and a loss of image. The last inspection in May 2022 was completed successfully. | Munich Airport conducts thorough and strict quality controls to manage the quality of all safety aspects at the airport. The quality controls have shown that the countermeasures taken and the consistent monitoring are effective and that – in theory and practice – very well trained personnel are employed. |

| Utilities and waste disposal facilities | Insufficient availability of utilities required for operations, such as electricity, heating, cooling, drinking and fire-fighting water, wastewater and waste, can lead to property damage and business interruptions. | The service and maintenance programs, network redundancies, and storage reduce the risk of gaps in supply. Property damage and interruptions of operations are insured. After taking the countermeasures into consideration, the net risk is below the risk tolerance limit. |

| Reorganization of ground handling | The success of the reorganization of the former Ground Handling business unit could be put at risk by the following uncertainties and circumstances: sustained reductions in traffic from existing customers, ground handling losses due to the transfer of part fleets to third parties, aggressive pricing policies of competitors, and increasing price decline at Munich Airport. | In the negotiations to extend the long-term contract with an important customer of AE Munich, a contract was concluded at the end of 2016 until October 2024. As a result, associated collective restructuring agreements could be extended. To compensate for declining ground handling volumes, talks with potential new customers are ongoing. In the event of a loss of ground handling, capacities and associated costs will fall. Constant monitoring and reporting of the renovation progress and renovation path is carried out. |

| Personnel situation | As traffic improves again, there is a risk of labor shortages, which could lead to long wait times and delays in aircraft handling. Regardless of the tight staffing situation, care is taken to ensure that sufficient qualified personnel are available to maintain operator responsibilities. In view of the overall economic situation and the wage developments observed in the market, it is expected that personnel costs will rise faster than in the past. | FMG is reviewing the introduction of bonuses for critical areas and has also introduced relief packages to support employees (early rate increases, increased driving cost allowances). Recruiting measures have also been intensified. |

| Drones | After the German government adopted stricter rules on the operation of drones in airport control zones in 2017, the EU Commission added a regulation on the safe operation of drones in 2019. At the national level, legal responsibility was regulated on this basis. German Air Traffic Control (Deutsche Flugsicherung – DFS) is responsible for all German commercial airports. Details of this were published in the Federal Law Gazette on June 17, 2021 and are in force. In the coalition agreement of the German government, the detection and defense of drones is classified as a sovereign task. It therefore does not lie with the airport operator. | Munich Airport has taken measures to minimize the impact on operations in terms of safety and security. This includes, among other things, participation in the uniform regulation of drone traffic via associations (ADV, ACI, BDL) as well as participation in EASA initiatives, public education, and participation in a test project on «Technology for Future Drone Detection» with DFS. The systems demonstrated in the test project need to be further developed to ensure effective, reliable use at commercial airports. To this end, DFS, with the support of Munich Airport, is in close contact with system manufacturers. After taking the countermeasures into consideration, the net risk is below the risk tolerance limit. |

Legal risks

| Risk | Description and analysis | Countermeasure(s) |

|---|---|---|

| Construction price increases | Risks can arise in construction projects from increases in construction prices, supplier defaults, planning delays and external influences from the public, the environment, politics, changes in technology, rules of technology or other requirements, including the postponement of construction projects. At this time, Germany has a shortage of building materials due to the crisis. | The investment projects are planned appropriately in terms of their commercial viability, their financial feasibility and the risks associated with the investments, and are monitored continuously during implementation. Currently, storage space is made available so production and supply shortages of affected building materials can be averted. Moreover, time reserves for possible delivery delays are taken into account in the overall schedule. The gross risk here is below the risk tolerance limit set by FMG and is therefore not represented in the risk matrix. |

| 98th amendment | Due to the political moratorium and the resulting postponement of the decision to realize the third runway, all planning and land acquisition costs incurred to date must be tested for impairment on an ongoing basis and written off if necessary. Without an increase in capacity brought about by the construction of the third runway, there could be capacity bottlenecks and a significant loss of company value in the medium and long term. This will be influenced primarily by a stagnation or decline in the traffic volume and the associated lower revenues in the Aviation and Non-Aviation divisions. | The confirmation of the planning approval decision by the Bavarian Administrative Court (BayVGH) on February 19, 2014 and in the following year by the Federal Administrative Court limited the legal risks for project implementation. Diversification of the product range and expansion of foreign business are planned or already being implemented as countermeasures to the significant loss of company value. The appropriate expansion of the airside infrastructure remains a key strategic project for Munich Airport in the medium and long term. |

| EU General Data Protection Regulation | In addition to the legal risks listed in the risk matrix, there are risks in connection with the EU General Data Protection Regulation (GDPR). The GDPR expands the existing obligations arising from the Federal Data Protection Act (BDSG) and increases the legal, operational, and technical/organizational requirements for data protection. An infringement of these rights and obligations could incur high fines, claims for damages, reprimands, and reputational damage. Currently, Munich Airport is considering issues related to the use of closed circuit television (CCTV) video surveillance and the use of Microsoft 365. | At Munich Airport, the project to implement the requirements of the GDPR has been successfully completed. As part of this, organizational structures and processes as well as their documentation were adjusted and awareness of data protection was heightened within the Group. The following measures were implemented to address data protection risks from CCTV: role usage concept, re-signage to indicate video surveillance, renegotiation of the company agreement on CCTV, consolidation of the legal basis, implementation of a data protection consequence assessment. Munich Airport has also appointed data protection officers and data privacy coordinators who receive awareness training and other types of training on a regular basis from the Group’s Compliance unit. The gross risk here is below the risk tolerance limit set by FMG and is therefore not represented in the risk matrix. |

Munich Airport is confronted with various legal disputes during the normal course of business. These can lead, in particular, to the payment of compensation claims or, in the case of construction projects, to changes in the remuneration of services. Moreover, other legal disputes can be initiated or existing legal disputes can be expanded. Apart from matters for which provisions have already been made in the balance sheet, Munich Airport is not currently anticipating any material negative impacts for the assets, financial position, and results of operations from other known cases at the present time.

In the case of foreign subsidiaries, risks may arise in particular from the assumption of operational responsibility abroad in the context of consulting services for other airports and the operation of terminals. Airport operating projects, like the Munich location itself, are subject to general economic and company-specific risks. To minimize risk, Munich Airport therefore works with local partners who have experience with respect to the specific country regulations and conditions. Risks can arise, in particular, with what are typically long-term airport operator projects, when it comes to assessing future aviation development and consumer behavior on the part of air travelers. To counter liability risks for Munich Airport in particular, local limited liability companies have been established outside Germany to act as independent entities and as local contractors. Risks may also arise from unforeseen regulatory intervention in the tariff, tax and levy structure of airports or from contractual breaches to the detriment of airport operators.

Tax (operational) audits by the tax authorities are also considered a general risk.

Financial risks

The expected financial liability for the gross financial risks listed below were under the reporting limit as at December 31, 2022. Therefore they were not included in the risk reporting. The monitoring and management of these risks are the responsibility of central finance and cash management.

Financial risks

| Risk | Description and analysis | Countermeasure(s) |

|---|---|---|

| Currency risks | Currency risks arise insofar as planned sales in foreign currencies are not balanced by any corresponding expenses or outgoings in the same currency. | Munich Airport hedges currency risks using forward exchange transactions. |

| Credit and reliability risks | Credit and credit rating risks primarily arise from short-term deposits as well as trade receivables. | Deposits are (generally) only made with (German) banks with deposit protection. The management of credit risks includes the constant monitoring of debtors’ creditworthiness, overdue invoices, and stringent collections management. Dependent on the credit rating, certain services are only performed against prepayment or provision of collateral in the form of guarantees. |

| Interest rate risks | Interest rate risks largely arise from floating-rate financial liabilities with respect to loans and financial liabilities to shareholders. In particular, the interest change risk for the shareholder loans increases as the European Central Bank (ECB) will probably continue to raise the base rate. | Interest rate risks from floating-rate financial liabilities from loans are countered by Munich Airport by hedging with interest rate swaps. Strategies for limiting the medium-term interest risks are currently examined against the background of a dynamically changing environment. |

| Liquidity risk | Liquidity risks may arise from banks’ lending practices and changes in the general conditions on the capital market with regard to the assets, financial position and results of operations. Munich Airport monitors risk as part of its long-term business planning and short and medium-term financial planning. | Munich Airport has set up a separate liquidity management system to safeguard liquidity during the pandemic. Liquidity planning takes into account ongoing business, capital expenditure and financing aspects for the entire Group. It also focuses on ensuring access to credit and capital markets. In order to ensure solvency at all times, long-term credit lines and liquid funds are made available based on a rolling liquidity plan. |

After considering countermeasures, the following net risks remain:

Overview of net risks

Overall assessment of the opportunities and risk situation

It is important for Munich Airport to actively seize opportunities as they arise in order to secure and further improve its position in the market through steady growth. However, it is also a key objective of Munich Airport to recognize risks in good time and to counter them systematically.

Therefore, the actual expected impact of possible events and developments is already taken into account in the business planning every year. The reported opportunities and risks are defined as potential deviations going beyond the forecast corporate result. Munich Airport consolidates and aggregates the risks reported by the corporate divisions and Group companies, and reports quarterly to the Executive Board and shareholders. Opportunities are identified and managed in collaboration with the Finance and Controlling department.

The spread of the coronavirus and its impact on global air traffic have had a significant negative impact on the risk situation at Munich Airport. Taking this situation into account, the risks were reviewed or reclassified at the beginning of the pandemic. The Executive Board expects that the economic impact of the coronavirus pandemic will continue to affect earnings. However, the further course of the pandemic is not foreseeable, so that a conclusive risk assessment is not possible at the present time.

No risks were foreseeable from the Group-wide risk management system or in the assessment of the Executive Board during the current forecast period, which individually or in their entirety could jeopardize the continued existence of Munich Airport. As in the previous year, management is confident that access to liquidity to meet financing needs will be available to overcome the challenges posed by the coronavirus pandemic and the war in Ukraine. With its diversified business units, Munich Airport’s fundamental earnings power forms a solid basis for exploiting opportunities for future business development and for providing the necessary resources to accomplish this.

Munich Airport would like to point out that various known and unknown risks, uncertainties and other factors could lead to material differences between the actual events, the financial situation, the development or performance of the company and the estimates given here.

Munich, April 17, 2023

Jost Lammers Nathalie Leroy Jan‑Henrik Andersson